The IRS has released the special trucker per diem rates and tax brackets for 2020

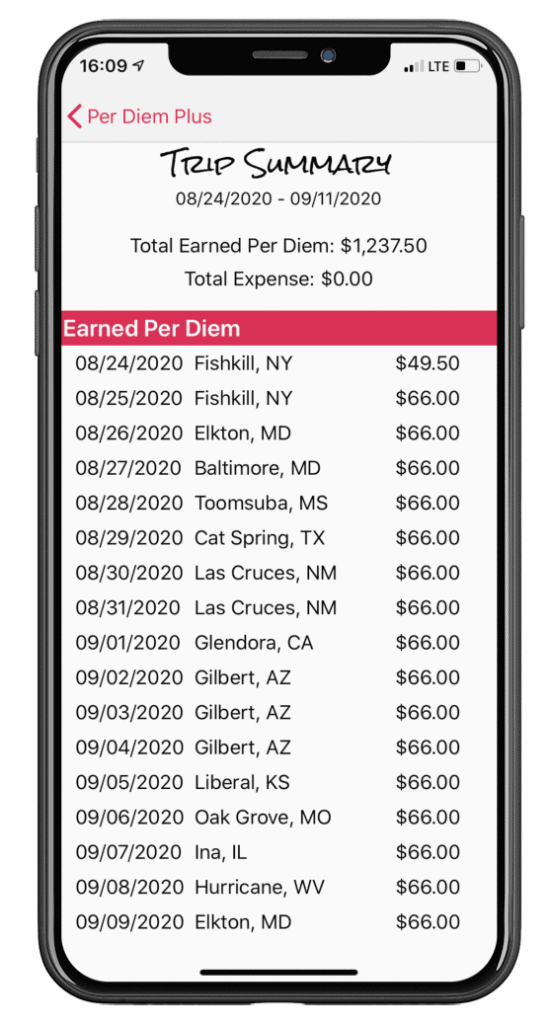

Trucker Per Diem Rates

The 2020 trucker per diem rates & tax brackets for taxpayers in the transportation industry remain unchanged from 2018-2019 and are $66 for any locality of travel in the continental United States (CONUS) and $71 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

- Furthermore, it is section 4.04 that allows an Owner-Operator or a motor carrier that offers a company-sponsored per diem plan to deduct 80% of per diem.

- The tax deductibility of per diem is limited to 50% for the other substantiated per diem options governed by Section 4.01 and 5 of Rev. Proc. 2011-47.

Introducing Per Diem Plus Small Fleets, an affordable, customizable per diem solution for solo and team operators

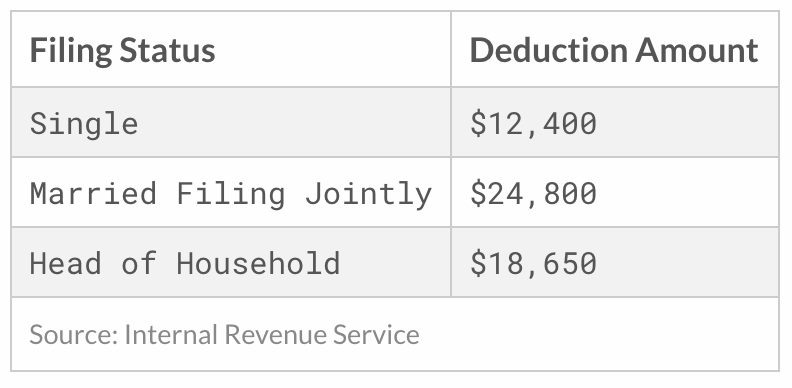

Standard Deduction & Personal Exemption

The standard deduction for single filers will increase by $200, and by $400 for married couples filing jointly.

The personal exemption for 2020 remains eliminated.

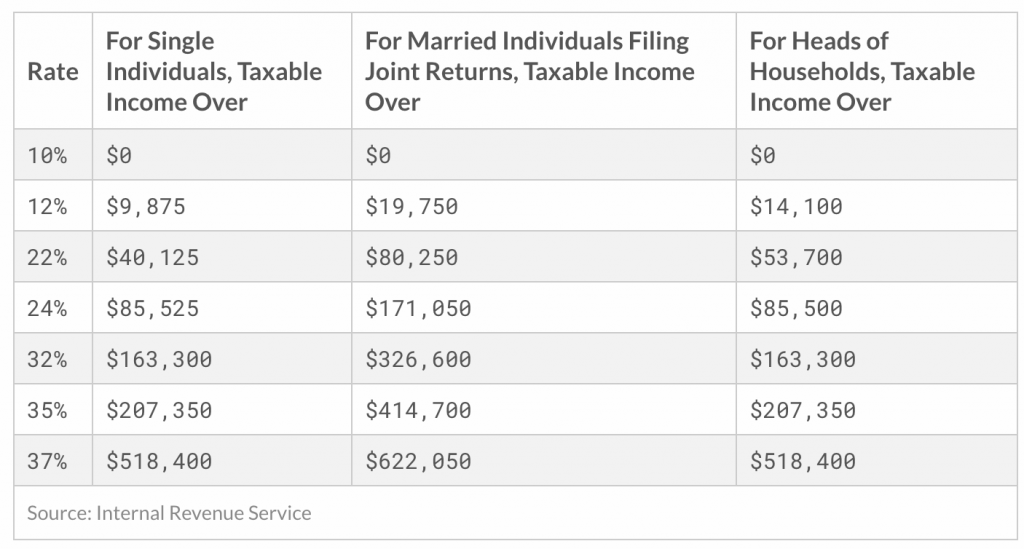

2020 Tax Brackets

In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly.

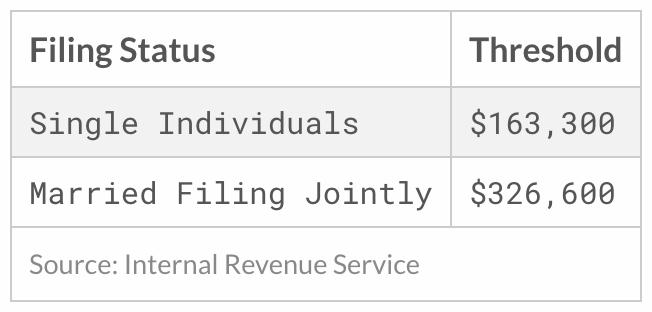

Qualified Business Income Deduction (Sec. 199A)

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to $163,300 of qualified business income for single taxpayers and $326,600 for married taxpayers filing jointly.

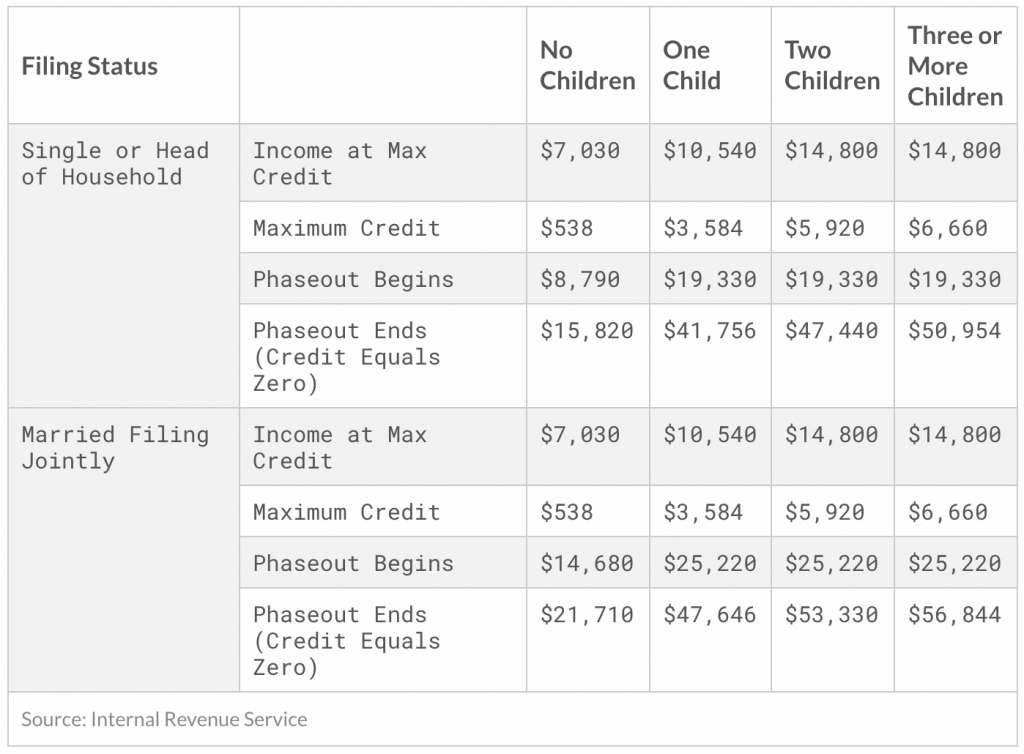

Earned Income Tax Credit

The maximum Earned Income Tax Credit in 2020 for single and joint filers is $538, if there are no children. The maximum credit is $3,584 for one child, $5,920 for two children, and $6,660 for three or more children. All these are relatively small increases from 2019.

Drivers, try Per Diem Plus or Small Fleets absolutely free for 30 days!

PDP Small Fleets requires users to complete the account setup HERE before using the app.

About Per Diem Plus

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2019-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Internal Revenue Service, “Revenue Proc. 2019-44,” https://www.irs.gov/pub/irs-drop/rp-19-44.pdf.