Designed by drivers, built by tax pros

Is trucker per diem a wage reclassification?

No. The treatment of per diem as a portion of an employee’s wages is not considered an improper “wage reclassification”. The IRS first introduced per day allowances in Revenue Procedure 90-60 as a simplified method of substantiating employee business expenses. However, the first published guidance for the transportation industry was TAM 9146003 issued in 1991. According to the IRS:

- A driver's weekly compensation,

- Earned on a cents-per-mile basis,

- May be reduced by specific amounts designated as per diem for meals and incidental expenses for each day away from home overnight (i.e. $66/day).

- Is not considered a wage reclassification

What is the special transportation industry per diem?

The Special Transportation Industry substantiated method was introduced in 2000 to ease the burden on taxpayers, who would otherwise have to meet the extensive substantiation requirements in order to claim deductions for business related travel [See Rev. Proc. 2000-39, 2000-9 Sec. 4.04, Notice 2000-48], which among other things:

- Established a method allowing a payor to treat a specific amount as paid or incurred for employee meals while traveling away from home for work instead of substantiating actual costs (no receipts required).

- Set $40 as the nationwide federal meals and incidental expenses (M&IE) rate for transportation employees subject to DOT hours of service. [Increased to $66 in 2018 & $69 in 2022] [i]

- Increased the tax-deductible percentage of employee travel expenses to 60%. [Raised to 80% in 2008] [ii]

- Approved as a transportation industry standard prior to December 12, 1989 the treatment of a portion of a driver’s wages as per diem. [iii]

- Required a fleet using the cent-per-mile method to include a process that;

- tracks the amount of cents-per-mile M&IE allowance paid to a driver on a per diem basis,

- includes a mechanism to determine when allowances exceed the amount of expenses that may be deemed substantiated, and

- treat the excess allowance over $40 per day as wages for withholding or employment tax purposes. [Increased to $66 in 2018 & $69 in 2022][iv]

- Established that all amounts paid under a expense reimbursement arrangement that meets the requirements of business connection, substantiation, and returning amounts in excess of expenses are treated as paid under an accountable plan and are excluded from income and wages.

The Internal Revenue Code gives the IRS Commissioner discretionary authority to issue regulations, such as revenue rulings and procedures. The Revenue Procedures and Notices are updated annually and the relevant per diem provisions have remained substantially the same since 2011 [See Rev. Proc. 2011-47 ].

Biden's IRS Is Coming For Your PayPal & Venmo Payments

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

What is a substantiated per diem program?

A substantiated per diem program reimburses drivers a fixed amount per day (i.e. $66) in place of a rate per mile for travel away from home. As a result, it eliminates the need for drivers to turn in receipts for actual meals and incidental expenses. Most importantly, it reduces a fleets administratives burden while providing additional cash to drivers on a pre-tax basis. However, companies must have an accountable plan to qualify, which would include these requirements [See KMS Transport Advisors (NAFC March 2019 newsletter]:

- The travel must have a business purpose

- There should be logs showing that you adequately account for the eligible amount within a reasonable period of time

- The amount should be tested regularly to ensure that drivers are not exceeding the allowable amount

- Employees must return any excess reimbursement or allowance within a reasonable period of time or treat the overage as compensation

- Drivers receiving the per diem must be over the road, meaning out overnight, where they cannot reasonably be expected to complete a route without sufficient rest

Do any well-known fleets use the special trucker per diem method?

Well-known motor carriers that utilize the substantiated method include Averitt Express, EPES Transport System, TMC Transportation, G&P Trucking, Transport America and Big G Express, Danny Herman Trucking and Oakley Transport.

What documentation meets the IRS substantiation requirements?

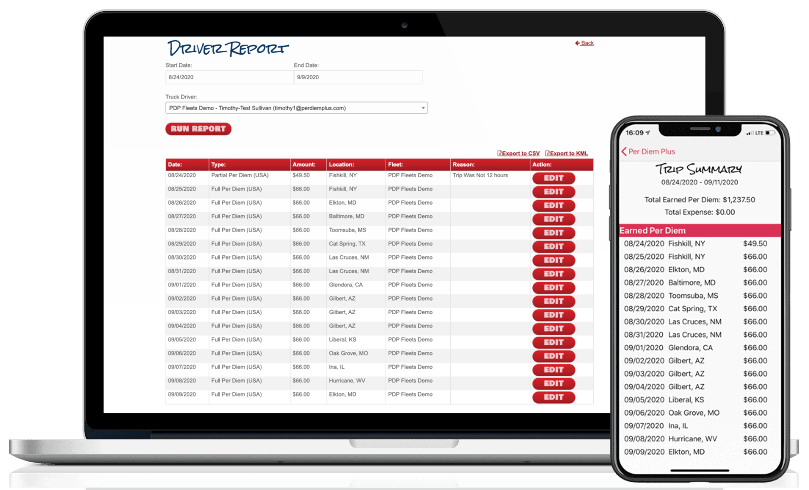

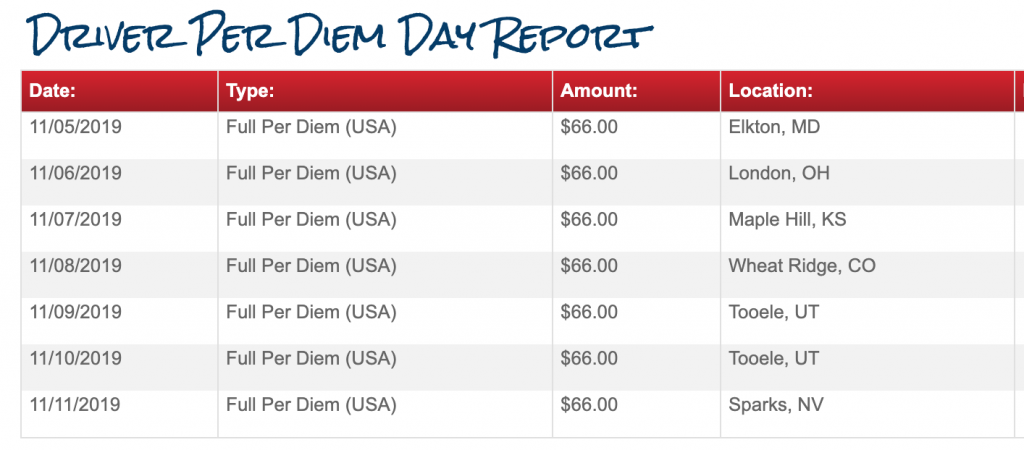

Only Per Diem Plus FLEETS platform or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event meet the IRS substantiation requirements.

Conclusion

Thirty years of IRS guidance and legislative history specifically reference an employer paying a driver in the transportation industry under the substantiated method and, therefore, contemplate that some portion of a driver’s wages will be treated as per diem. While, both the substantiated and cent-per-mile per diem methods are IRS-compliant, neither method has been considered an improper wage reclassification for over 30 years. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

Get in touch with the experts at Per Diem Plus today to discuss a smooth rollout for your system.

About Per Diem Plus FLEETS

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS. Additional information can be found at IRS.gov

[i] The 2019 per diem rate for travel in the USA is $66 and $49.50 for a partial day.

ii] The raised the deductible percentage of employee travel related expenses to 80% in 2008

iii] Federal Register-1989-12-12 Vol 54 Page 51038 pursuant to “Family Support Act of 1988”

[iv] Rev. Ruling 2006-56, 2006-2 CB 274

[i] Updated annually IRS Notice 2019-55, 2018-77, 2017-54, 2016-58, 2015-63, 2014-57, 2013-65, 2012-63, Rev. Proc. 2011-47, 2010-39, 2009-47, 2008-59, 2007-63, 2006-41, 2005-67, 2004-60, 2003-80, 2002-63 and 2001-47.