Designed by drivers, built by tax pros

Raise Trucker Pay To Attract New Drivers

Use Per Diem To Raise Trucker Pay To Recruit Drivers. A company-sponsored substantiated per diem plan can raise trucker pay to attract new drivers.

Our cloud-based FLEETS mobile app platform with flexible Service Plan Options enables motor carriers to easily implement an IRS-compliant fleet per diem plan that will:

- Enhance recruiting and retention

- Raise driver pay by 10% or more

- Save a fleet several thousand dollars per driver

- Eliminate the need to retain ELD backups for 3 years

"I still think to get new people into the industry, given the 150K-200K driver deficit and robust demand in 2021, pay is going to have to go up a lot more than 20%."

U.S Express CEO Eric Fuller told Yahoo Finance (9/30/20)

The Numbers Speak For Themselves

Adding a substantiated per diem program for employee drivers is a sure-fire way raise driver take-home pay by 10% or more while saving the motor carrier money. Consider the following:

- The typical over-the-road (OTR) driver averages 127,000 miles annually and is away from home 295 nights a year

- A driver would receive $19,470 of tax-free per diem at $66/day[1]

- Unlike a cent-per-mile plan it can be earned during HOS-mandated 34-hour restarts and unforeseen delays

- The average driver will save thousands of dollars in income and payroll taxes, equivalent to several cents per mile

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets

TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

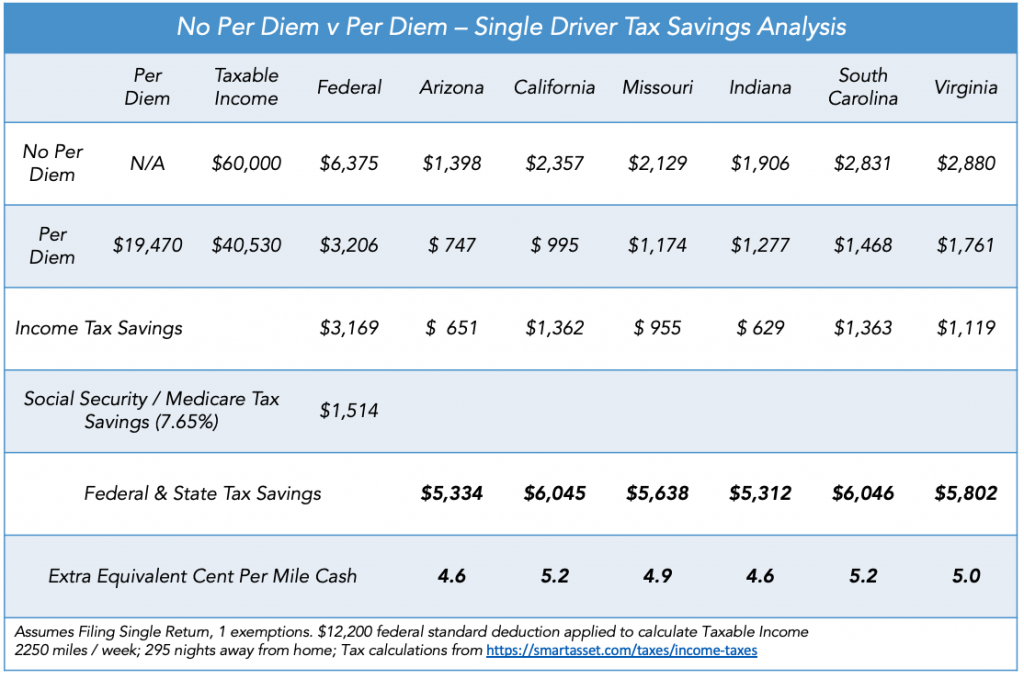

Example - Driver Savings

A single driver from South Carolina could save $6,046 in taxes equal to an extra 5.2 cents-per-mile. Learn how state tax rates impact per diem in our post State Income Tax Considerations of Driver Per Diem

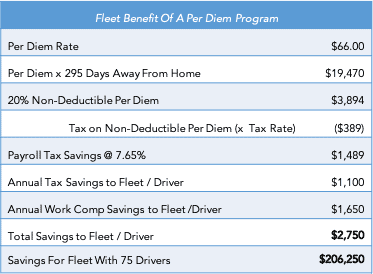

Example - Fleet Savings

A fleet with 75 drivers and could raise driver pay by 10% or more and still save $206,250. Do not believe the savings are achievable? Read our Case Study. The motor carrier saved $3,000 per driver within the first year of implementing Per Diem Plus Fleets. In addition, they received a $125,000 workers compensation premium refund.

Our cloud-based FLEETS mobile app platform enables fleets to easily implement an IRS-compliant fleet per diem plan that will raise driver take-home pay by 10% or more while also saving the motor carrier money.

Related Articles:

Implementing Per Diem Plus® FLEETS into Your Fleet to Ensure a Smooth Rollout

Raise Driver Take-Home Pay with Per Diem

About Per Diem Plus FLEETS

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®