2021 TAX LAW UPDATE - READ ABOUT 100% DEDUCTION FOR PER DIEM

Are self-employed truckers eligible for the refundable tax credit available under the Families First Act?

Yes. As a self-employed trucker you cannot do your job via a ZOOM meeting, thus you are eligible for a refundable tax credit under the Families First Act (FFCRA). You may fund the "sick leave" or "family leave" tax credit by using a portion of the 2020 estimated tax payments that were supposed to be paid quarterly. The refundable credit will be claimed on your Form 1040, U.S. Individual Income Tax Return, for the 2020 tax year.

Specific Families First Act Provisions for Self-Employed Individuals

Who is an eligible self-employed individual for purposes of the Families First Act tax credit?

An eligible self-employed individual is defined as an individual who,

- Regularly carries on any trade or business, and

- Would be entitled to receive qualified sick leave wages or qualified family leave wages the individual were an employee.

Eligible self-employed individuals are allowed an income tax credit to offset their federal self-employment tax for any taxable year equal to their “qualified sick leave equivalent amount” or “qualified family leave equivalent amount.”

How is the Families First Act tax credit calculated?

The tax credit is calculated by multiplying the number of days you could not work (maximum of 10 days) between April 1 and December 31, 2020 by either:

- "Sick Leave Equivalent" - $511 or 100 percent of average daily self-employment income, or

- "Family Leave Equivalent" - $200 or 67 percent of average daily self-employment income

How is the “average daily self-employment income” for an eligible self-employed individual calculated?

Average daily self-employment income is an amount equal to the net earnings from self-employment for the taxable year divided by 260. A taxpayer’s net earnings from self-employment are based on the gross income that he or she derives from the taxpayer’s trade or business minus ordinary and necessary trade or business expenses.

Which credit do I qualify for, the “sick leave equivalent” or "family leave equivalent"?

Which type of "leave" you qualify for depends on the reason(s) you were unable to work. Those that were prohibited from working can claim up to $511/day but those who were home to care for a family member can only claim up to $200/day.

Quarantine / Isolation Orders - "Sick Leave Equivalent"

For an eligible self-employed individual who is unable to work or telework because the individual:

- Is subject to a Federal, State, or local quarantine or isolation order related to COVID-19;

- Has been advised by a health care provider to self-quarantine due to concerns related to COVID-19; or

- Is experiencing symptoms of COVID-19 and seeking a medical diagnosis,

the qualified sick leave equivalent amount is equal to the number of days during the taxable year that the individual cannot perform services in the applicable trade or business for one of the three above reasons, multiplied by the lesser of $511 or 100 percent of the “average daily self-employment income” of the individual for the taxable year.

Example: John was unable to drive due to state-mandated quarantine orders and the absence of loads for 8 days. He had $75,000 or an average of $288/day of self-employment income in 2020.

- 8 days x $511 = $4,088

- 8 days x $288 = $2,304

John can claim the lesser amount of $2,304 as refundable credit under FFCRA on his Form 1040, U.S. Individual Income Tax Return.

Caring for Sick Family Member - "Family Leave Equivalent"

For an eligible self-employed individual who is unable to work or telework because the individual:

- Is caring for an individual who is subject to a Federal, State, or local quarantine or isolation order related to COVID-19, or has been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

- Is caring for a child if the child’s school or place of care has been closed, or child care provider is unavailable due to COVID-19 precautions; or

- Is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor,

the qualified family leave equivalent amount is equal to the number of days during the taxable year that the individual cannot perform services in the applicable trade or business for one of the three above reasons, multiplied by the lesser of $200 or 67 percent of the “average daily self-employment income” of the individual for the taxable year.

Example: Mary was unable to drive for 10 days because she was home caring for her husband who had been exposed to COVID. She had $65,000 or an average of $250/day of self-employment income in 2020.

- 10 days x $200 = $2,000

- 10 days x $168 ($250 x 67%) = $1,680

Mary can claim the lesser amount of $1,680 as refundable credit under FFCRA on his Form 1040, U.S. Individual Income Tax Return.

How does a self-employed individual claim the credits for qualified sick leave equivalent amounts or qualified family leave equivalent amounts?

The refundable credits are claimed on the self-employed individual’s Form 1040, U.S. Individual Income Tax Return, tax return for the 2020 tax year. The Families First Act refundable tax credit is not surprisingly complicated, please consult with your tax advisor.

How should "sick" or "family" leave be substantiated?

Substantiate the days you were unable to work using either of the following methods:

- DOT logbook showing "Off Duty" status, or

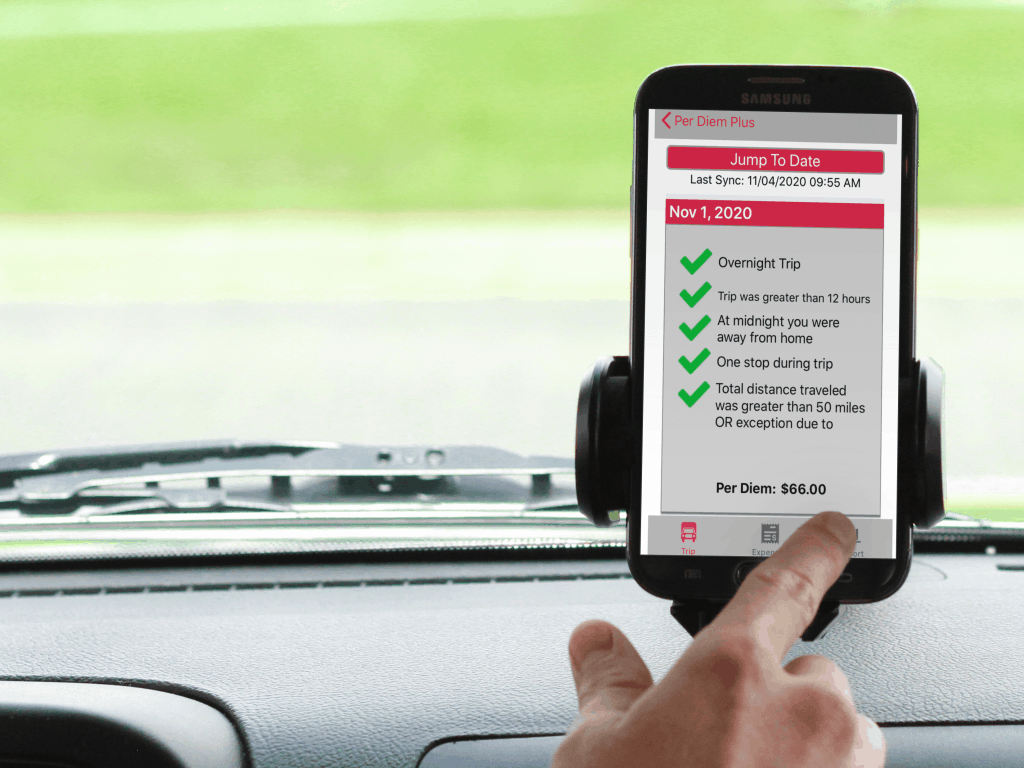

- Per Diem Plus - Owner Operator showing "Not On Trip" status

About Per Diem Plus

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.