Designed by drivers, built by tax pros

In this article we attempt to clear up the confusion on company-paid per diem caused by the recently passed Tax Reform and Jobs Act.

How did tax reform affect employee truck drivers and company-paid per diem?

Under the 2017 Tax Reform and Jobs Act[i]:

- Employee drivers who travel away from home overnight will no longer be allowed to claim unreimbursed employee business expenses on Schedule A.

- This includes per diem and other job-related expenses[1].

- Motor carriers can still offer company-paid per diem to their employee drivers.

The good news is that motor carriers can implement an IRS-compliant accountable per diem program using the Per Diem Plus® FLEETS mobile application platform to offset the lost tax deductions for their drivers, while enhancing recruiting and retention[ii].

“Partnering with Per Diem Plus provided Reliable Carriers a turn-key solution configured to meet the needs of our fleet and offer this benefit to drivers”

Nick Adamczyk, Controller

Reliable Carriers, Inc.

Will a company-paid per diem plan raise driver take home pay?

Yes. A motor carrier implementing a company-paid per diem plan can raise effective driver pay by 2.6¢ - 4¢ CPM. All per diem paid to a driver is treated as a non-taxable reimbursement and not reported on Form W-2.

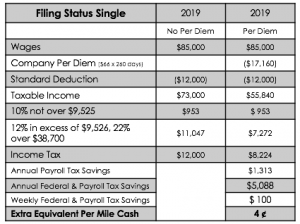

Example - Single Driver

- In 2017 the single driver earned $85,000 and incurred $17,160 of travel-related expenses he must cover using after-tax income.

- In 2019 the single driver earns $85,000 and elects to enroll in a company-paid per diem plan at $66 / day for each night he is away from home.

- His payroll and income tax bill will decrease by $5,088 equal to a 4¢ CPM pay raise.

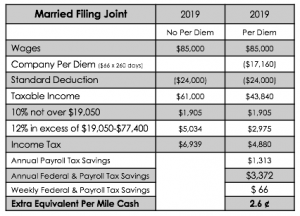

Example - Married Driver

- In 2017 the married driver earned $85,000 and incurred $17,160 of travel-related expenses he must cover using after-tax income.

- In 2019 the married driver earns $85,000 and elects to enroll in a company-paid per diem plan at $66 / day for each night he is away from home.

- His payroll and income tax bill will decrease by $3,372 equal to a 2.6¢ CPM pay raise.

Employee transparency

Per Diem Plus was designed by drivers. Your mobile app ensures trip data is instantly accessible to drivers, which enables them to actively check/monitor their own per diem. Getting buy in from your drivers will maximize the driver and fleet benefits while streamlining administration on the program for your human resources team.

Some careful scoping and planning at this early stage can go a long way towards ensuring your business is matched with its ideal fleet per diem management solution.

Get in touch with the experts at Per Diem Plus today to discuss a smooth rollout for your system.

Purchasing a fleet per diem mobile solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of our automated per diem solution.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

Copyright 2018 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[1] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and miscellaneous expenses.

[2] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[3] In accordance with IRS Revenue Procedure 2011-47 Sec 4.04 (superseded most recently by Notice 2017-54) covers meals and incidental expenses only. A driver can deduct 80% of per diem.

[i] All amounts paid under the arrangement are treated as paid under an accountable plan and are excluded from income and wages.

[ii] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits” and other job-related expenses.