Designed by drivers, built by tax pros

Clearing up the confusion over tax reform and trucker per diem

In this post I attempt to clear up the confusion over tax reform and trucker per diem. Tax Reform has contributed to much confusion within the professional truck driver community about the changes as they related to the deductibility of certain expenses. Case in point: a recent magazine article declared,

Additional good news for truckers in this bill is that HR1 does not change overnight per diems (Section 274(n)(3) of the IRC Code). That means truckers retain the ability to claim 80 percent of the $63 per diem for nights away from home.

Land Line “Tax Reform and Trucking” (January 8, 2018)

This statement is misleading and overlooks a significant difference between owner operators who are self-employed and employee (company) drivers. The article cited the retention of per diem under Internal Revenue Code Section 274(n)(3)[ii], which is correct.

IRC Section 274 and per diem

Unfortunately, the articles author misunderstood the meaning of Sec. 274, which pertains solely to the meals expense disallowance and establishes the 80% deduction limitation for per diem of a truck driver during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation. What the article failed to articulate was that:

- Owner Operators (self-employed drivers) claim per diem under IRC Sec 162(a)(2)[iii]

- Company drivers (employee) previously claimed per diem as a miscellaneous itemized deduction under IRC Sec 67[iv].

- Drivers that receive a non-taxable per diem reimbursement from their employer (trucking company) do so under IRC Sec 62(2)(a).

What tax reform eliminated

The Tax Reform and Jobs Act (H.R. 1 Sec. 11045) amended IRC Sec 67 and suspended (eliminated) miscellaneous itemized deductions for employee drivers, which includes per diem and other unreimbursed employee business expenses[v]. As a result, self-employed owner operators will still be allowed to claim per diem, but employee drivers will not.

Tax reform and company-paid per diem

The Act did not amend IRC 62(2)(a), thus trucking companies will be allowed to continue offering company-paid per diem under an accountable plan that is treated as a non-taxable reimbursement to their employees.

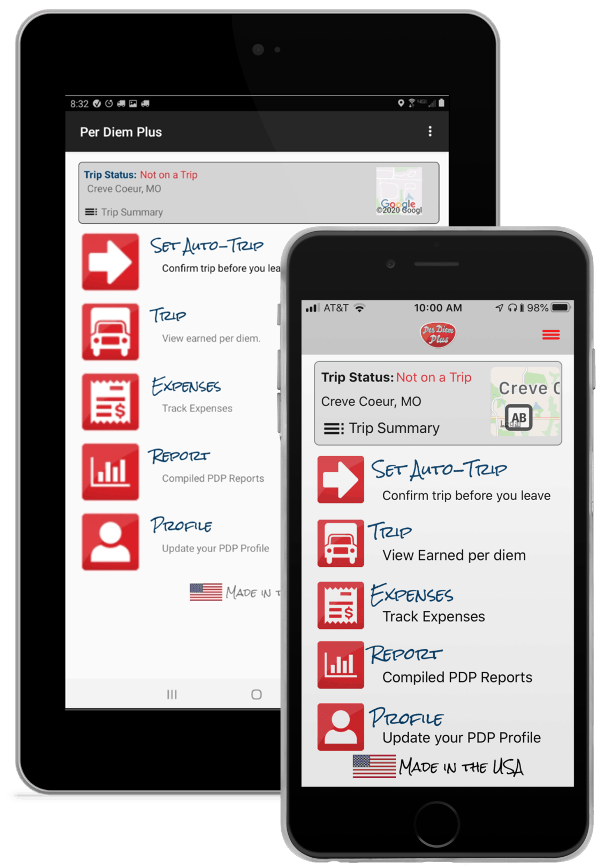

Drivers, try Per Diem Plus FREE for 30 days - No Credit Card Required

About Per Diem Plus

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

About the Author

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Please remember that everyone’s financial situation is different. This article does not give and is not intended to give specific accounting and/or tax advice. Please consult your own tax or accounting professional.

[ii] 26 U.S. Code § 274 - Disallowance of certain entertainment, etc., expenses

(n) Only 50 percent of meal and entertainment expenses allowed as deduction

(1) In general, The amount allowable as a deduction under this chapter for—

(3) Special rule for individuals subject to Federal hours of service

In the case of any expenses for food or beverages consumed while away from home (within the meaning of section 162(a)(2)) by an individual during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation, paragraph (1) shall be applied by substituting “80 percent” for “50 percent”.

[iii] IRC 162(a) In general

There shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including—

(2) traveling expenses (including amounts expended for meals and lodging other than amounts which are lavish or extravagant under the circumstances) while away from home in the pursuit of a trade or business

[iv] IRC 67 (a) General rule

In the case of an individual, the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted gross income.

IRC 62(2)(a) - Reimbursed expenses of employees

The deductions allowed by part VI (section 1616 and following) which consist of expenses paid or incurred by the taxpayer, in connection with the performance by him of services as an employee, under a reimbursement or other expenses allowance arrangement with his employer. The fact that the reimbursement may be provided by a third party shall not be determinative of whether or not the preceding sentence applies.

[v] Under H.R. 1 “Tax Cuts and Job Act” OTR employee truck drivers will no longer be allowed a tax deduction under IRC 67 for unreimbursed business expenses, which includes “meal expenses that take place during or incident to any period subject to the Department of Transportation's “hours of service” limits”.