Designed by drivers, built by tax pros. Per Diem Plus for Samsara automates administration of an IRS-compliant, accountable record of trucker per diem for OTR drivers.

What do you need to do to enroll in the per diem plan for your company? Contact Human Resources or your driver manager.

.

Select the SET AUTO-TRIP to start a trip.

The app will auto-activate 10 air miles from your tax home.

Drive through (transit) your tax home halo?

REFRESHING TRIP DATA

Cellular connectivity and network traffic volumes occasionally prevent the app from automatically updating per diem data. Select the Help menu then "Syncronize Data with Server" to refresh current trip.

Never-Lost Feature: Record per diem, expenses and receipts are stored on the secure PDP cloud and instantly accessible on your device for 4 years.

Select the TRIP tab to view:

Select TRIP SUMMARY to view recorded per diem and expenses for your current truck driving trip.

Select the EXPENSES tab to:

Select the REPORT tab to:

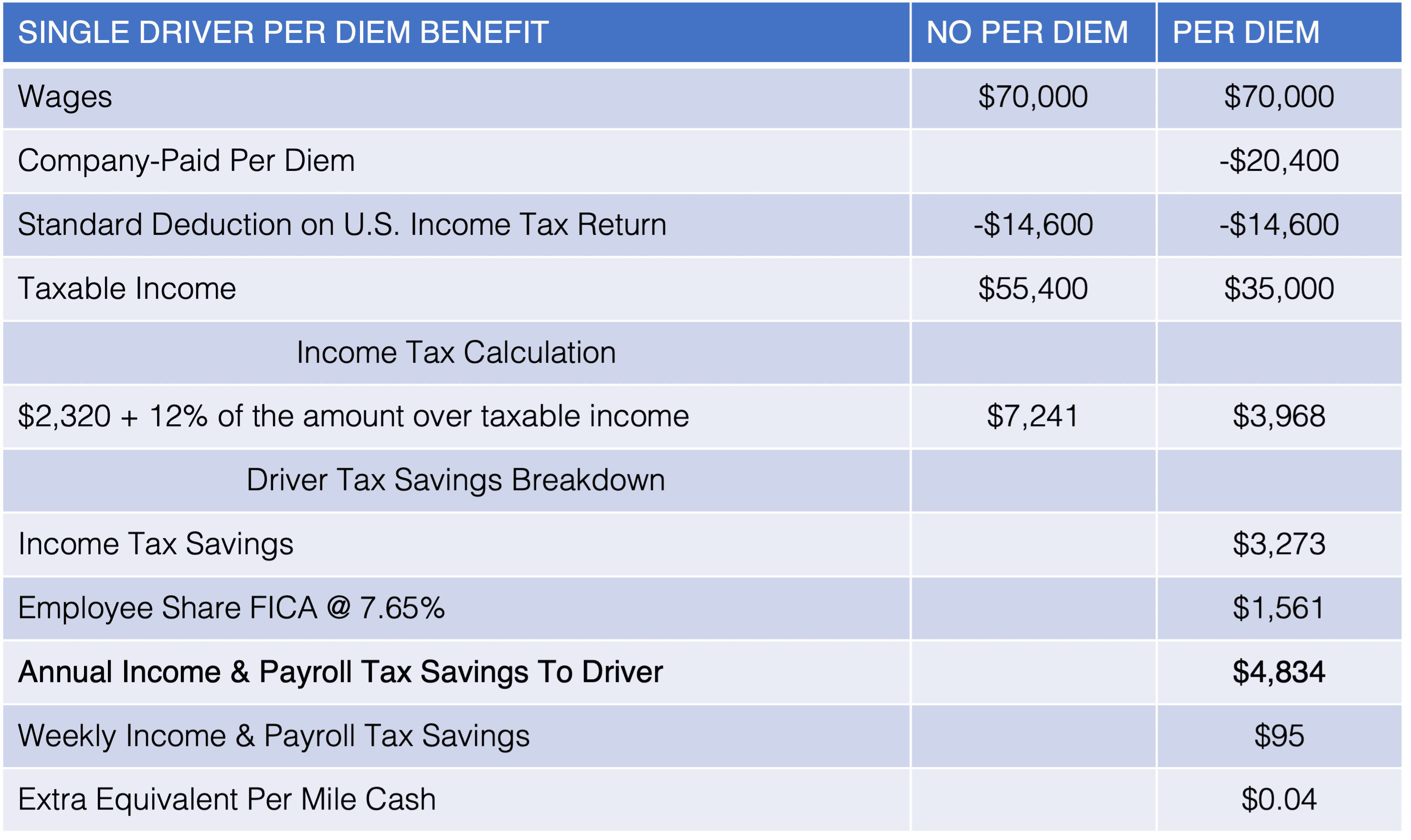

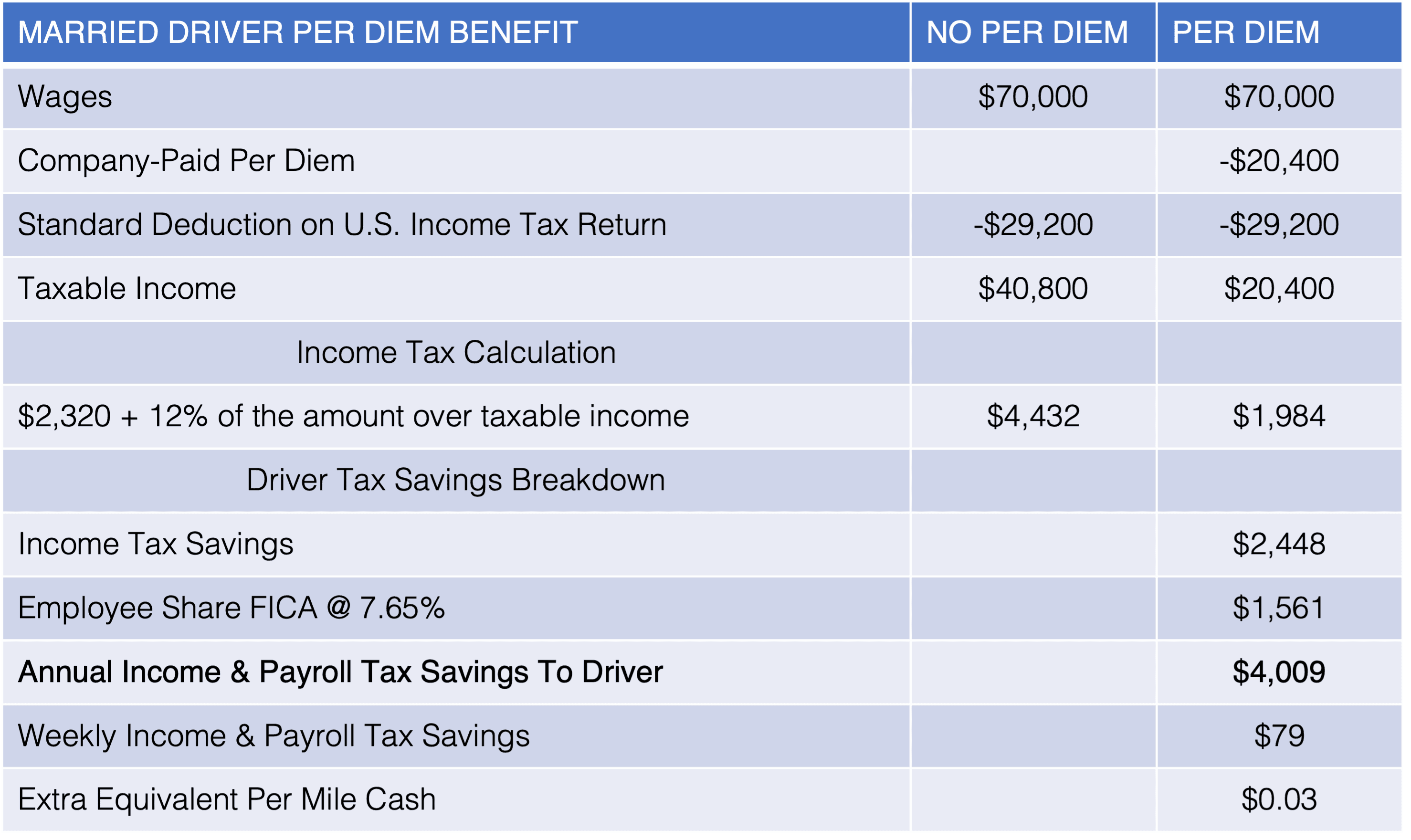

As of January 1, 2018, employee drivers are no longer allowed to claim unreimbursed employee business expenses, like meals per diem, as a tax deduction on their federal income tax return. Arka Express is introducing an accountable, company-paid per diem plan in response to this tax law change.

What is per diem?

A per day travel expense allowance paid to an employee as an expense reimbursement under an accountable per diem plan.

Which drivers receive per diem?

Is company-paid per diem taxable to an employee driver?

No. It is considered a non-taxable reimbursement that is deducted from taxable wages.

How can I review the per diem earned for the current payroll period?

You only have to register once

Note: The Trip Summary will display the "last trip" up to 24hrs after entering the halo. After that it will no longer display.

Who do I contact if the per diem for the current Saturday-Sunday payroll period is incorrect?

Contact Per Diem Plus Support by phone/text at (314) 488-1919 by no later than Noon ET on Monday.

Will per diem move you to a lower federal income tax bracket?

It depends. For example, a married driver filing a joint return earning $100,000 of joint wage income that received $17,595 of per diem would drop down to the 12% tax bracket ($22,000-$89,450) from the 22% tax bracket ($89,451-190,000).

Will per diem reduce my vacation pay?

No. Vacation pay is still computed as before off gross wages.

How will per diem affect my Social Security?

The per diem pay plan will reduce social security benefits. However, you still come out ahead because you could save thousands in taxes each year under the per diem program and only lose out on $4 to $11 per month in social security benefits. Speak with a tax advisor for more information about your situation.

Do I have to login to Per Diem Plus for Samsara?

No.

How do I track a truck driving trip?

How much per diem will I receive?

Drivers traveling in the USA

Drivers traveling to Canada

Does a driver have to spend all the per diem?

No.

Will Per Diem Plus for Samsara record per diem if I sign out of Samsara ELD during a 10-hour HOS reset?

No. Per Diem Plus uses the Samsara ELD gateway to record location. When a driver uses "Off Duty Sign Out" the gateway ceases sending hourly location data and prevents Per Diem Plus from processing the logic rules used to calculate per diem.

Note: Use of "Off Duty Sign Out" is required to allow yard moves when you are broken down. Contact Per Diem Plus Support at (314) 488-1919 to have missed per diem corrected.

Will I receive per diem when I experience unforeseen delays, like weather, detention and breakdowns?

Yes. Per diem is also earned during 34-hour restarts undertaken away from home.

Is participation in the per diem plan optional?

Yes.

What does it cost to participate in the per diem plan?

Per Diem Plus for Samsara is provided at no cost to the driver.

Questions? Contact us at Support@Perdiemplus.com or (314) 488-1919