PDP For Fleets - 3 Months Free

Tax season is upon us, and it's time to prepare and file your tax return. But before you rush to submit your documents, it's crucial to take a step back and ensure your return is bulletproof against costly mistakes and potential IRS audits. Avoiding common filing errors by hiring a tax professional who can save you time, money, and stress in the long run.

By following these steps and exercising diligence in preparing your tax return, you can significantly reduce the likelihood of costly mistakes and IRS audits. Remember, investing time and effort in ensuring accuracy now can save you from headaches down the road. Stay proactive, stay informed, and bulletproof your tax return for a smoother filing experience.

By entrusting your tax preparation needs to us, you gain access to years of experience, comprehensive knowledge of tax laws, and a commitment to excellence in every aspect of our service. We'll work closely with you to understand your unique situation, identify opportunities for savings, and navigate any complexities with confidence.

Don't leave your financial well-being to chance. Partner with Mark Sullivan Consulting and gain peace of mind knowing that your tax return is in the hands of trusted professionals. Contact us today to schedule a consultation and take the first step toward a stress-free tax season. Let's make this year's filing process smooth, efficient, and rewarding together.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2025 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Refunds sent by mail are a popular target for check fraud

Taxpayer refund checks are being stolen from the mail, and in some cases, replacement checks are also being stolen.

While over 90% of taxpayers use direct deposit for refunds, millions still prefer paper checks.

Refunds sent by mail have become a popular target for check fraud, as reported by the Treasury Department last year.

IRS Commissioner Danny Werfel has repeatedly emphasized in public comments that direct deposit is the fastest and safest way to receive refunds.

The IRS has a process in place to replace lost or stolen checks.

The Treasury’s Financial Crimes Enforcement Network has issued alerts about a nationwide rise in mail theft-related check fraud.

The IRS is modernizing its core systems, with a significant upgrade planned to roll out next year.

With refund checks increasingly becoming a target for fraud, the safest way to receive a refund is through direct deposit. While the IRS is working on improvements, taxpayers should act now to protect their refunds from theft.

Mark Sullivan Consulting assists taxpayers who have fallen victim to refund fraud, providing expert guidance through the IRS refund replacement process. Our team will navigate the complexities of filing refund traces, working with the Treasury Department, and ensuring your case is handled promptly. With years of experience in federal tax controversy, we are dedicated to securing the refunds our clients rightfully deserve while protecting them from further fraud risks. Let us advocate on your behalf and restore your peace of mind.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2025 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Additional references: "Millions of Dollars in Tax Refund Checks Are Getting Stolen", Ashlea Ebeling, The Wall Street Journal (October 4, 2024)

2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

2025 trucker per diem rates were released by the IRS in an annual bulletin, Notice 2024-68, on September 20, 2024.

For taxpayers in the transportation industry the per diem rate remains unchanged form 2022 to $80 from $69 for any locality of travel in the continental United States (CONUS) and $86 from $74 for any locality of travel outside the continental United States (OCONUS), i.e Canada.

Effective Date: This notice is effective for per diem allowances for meal and incidental expenses, that are paid to any employee on or after October 1, 2024, for travel away from home on or after October 1, 2024.

Note: A motor carrier fleet or owner operator can continue to use the 2024 per diem rate of $69 / $74 until December 31, 2024.

See Notice 2024-68

Have questions about trucker per diem? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Copyright 2024 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

The IRS is ramping up its audit rates for large corporations, complex partnerships, and multimillionaires, thanks to a substantial funding boost from the Biden administration. By 2026, audit rates for corporations with over $250 million in assets will nearly triple, while complex partnerships and high-income individuals will also see significant increases. Despite these changes, the IRS reassures that individuals and small businesses earning under $400,000 won't face increased audit rates. This new focus underscores the importance of robust tax compliance and expert guidance.

Massive Funding Boost

Increased Audit Rates for Corporations

Focus on Complex Partnerships

Targeting Wealthy Individuals

Assurance for Lower-Income Entities

Audit Process

Discrepancies can lead to:

This detailed audit plan reflects the IRS's enhanced capacity to scrutinize high-value entities, backed by significant federal support.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Additional References: "The IRS says audits are about to surge — here’s who’s most at risk" Shannon Thayler, New York Post (May 3, 2024)

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Why choose Mark Sullivan Consulting, PLLC? As high-income taxpayers navigate the complexities of addressing unfiled tax returns and potential IRS settlements, it's essential to seek expert guidance and support. Mark Sullivan Consulting stands ready to assist in this critical process. With years of specialized experience in federal tax controversy, audit, and appeals representation, as well as tax consulting and advisory services, Mark offers unparalleled expertise and dedication to client success.

By retaining Mark Sullivan Consulting, high-income taxpayers can benefit from personalized guidance tailored to their unique financial situations and tax challenges. From preparing unfiled tax returns to negotiating settlements with the IRS, Mark Sullivan Consulting provides comprehensive support every step of the way. With a commitment to integrity, transparency, and excellence in service, Mark Sullivan Consulting empowers clients to navigate IRS compliance initiatives with confidence and peace of mind.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Navigating Tax Time: Tips To Avoid Common Pitfalls & Maximize Savings

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Tax season can be a stressful time for many Americans, but with a little knowledge and preparation, you can navigate it with confidence. Here are some practical tips to help you avoid common pitfalls and maximize your tax savings.

In conclusion, while tax season may seem daunting, taking proactive steps to understand your tax obligations and opportunities can lead to significant savings. Whether you're filing your taxes independently or with the help of a professional, attention to detail and awareness of potential pitfalls are key. By staying informed and organized, you can navigate tax time with confidence and optimize your financial outcomes. Remember, every dollar saved in taxes is a dollar that can contribute to your future financial security.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Struggling to find a tax accountant these days? The accounting industry lost 300,000 professionals since COVID began. Mark Sullivan Consulting, PLLC is adding income tax preparation services in response to taxpayer demand.

Embark on this journey with Mark Sullivan Consulting as we launch our new income tax preparation services. Let us take the complexity out of taxes, allowing you to thrive personally and in your business endeavors. Cheers to a seamless tax season ahead!

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

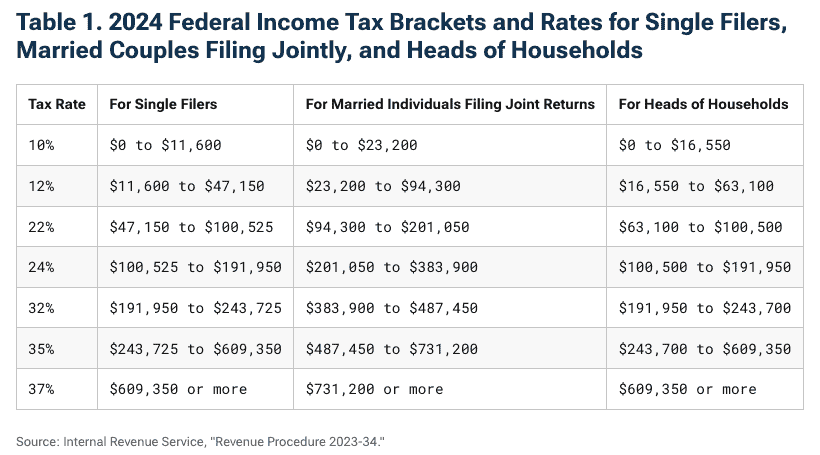

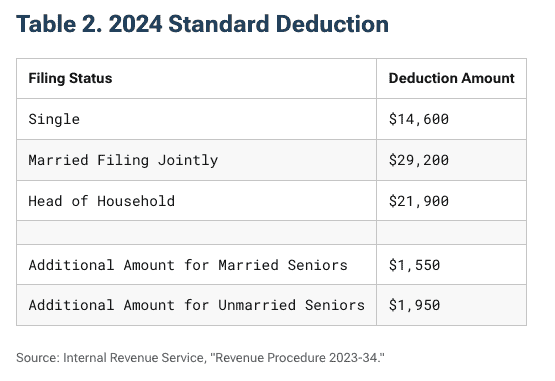

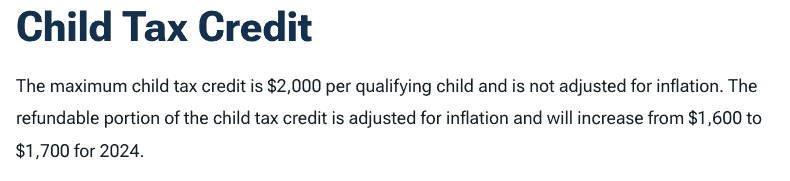

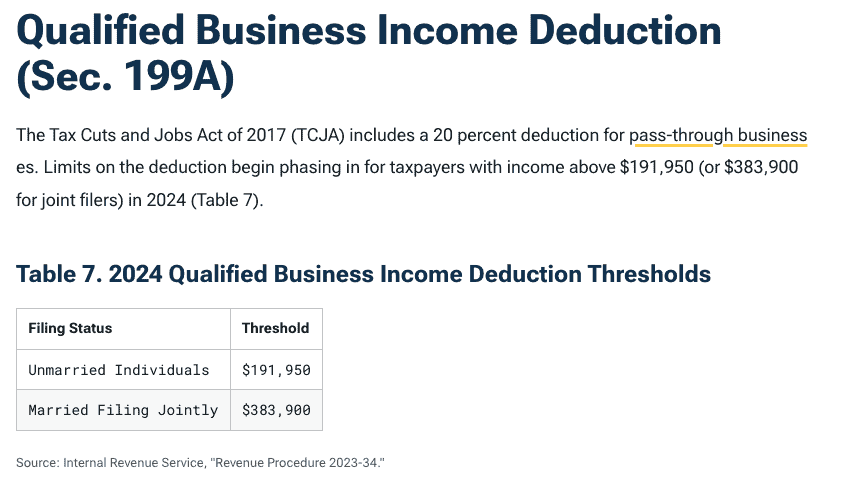

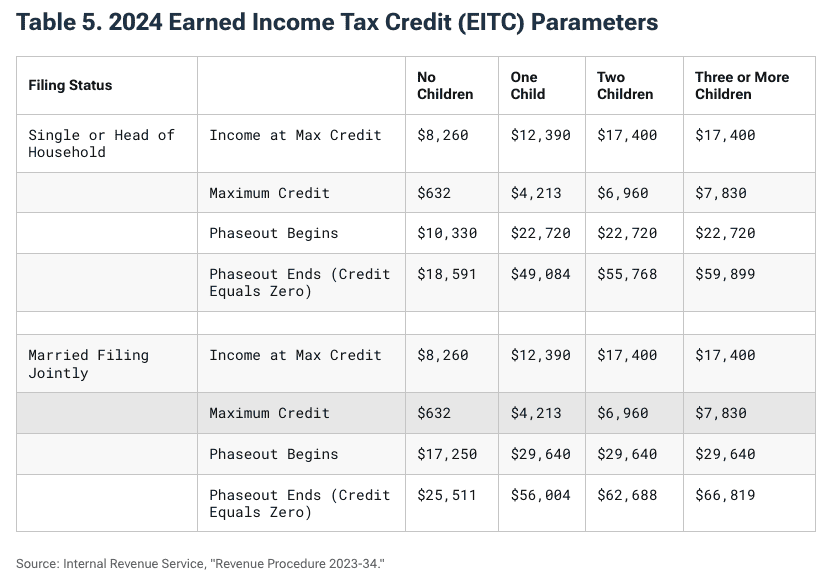

2024 trucker per diem rates and tax brackets were released by the IRS in Revenue Procedure 2023-34. For detailed information, please refer to the Tax Foundation.

For taxpayers in the transportation industry who are subject to DOT HOS the per diem rate remains unchanged from 2023 at $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS), i.e. Canada.

Mark Sullivan Consulting Launches New Income Tax Services For Truckers

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Source: "2024 Tax Brackets", Alex Durante, Tax Foundation (November 8, 2023)

Unlock Fleet Tax Savings Using Per Diem

The freight industry's landscape is evolving, and as diesel prices rise, fleet managers like you face challenges. However, here's the silver lining: optimizing your driver per diem can be a game-changer. Many fleets overlook the tax-deductible benefits of per diem, leaving money on the table.

In 2021 and 2022, Congress raised the trucker per diem deduction to 100%, making it even more enticing. But some might think that at 80% deductibility, per diem won't save much. That's where they're mistaken.

Case Study: Tax Savings

Let's break it down with a case study for a 25-truck fleet. The motor carriers realizes $71,428 or $2,857 per driver in savings. For married drivers earning $65,000 annually, the potential tax savings are around $3,457 or $0.03 cents per mile. Single over-the-road drivers in the same income bracket can save roughly $4,485, or $0.04 cents per mile. The fleet achieves

The key takeaway here is leveraging a fixed daily rate can maximize your tax offset, and it's a strategy worth considering. 💰

The Per Diem Plus Advantage

To make this process smoother, consider using the Per Diem Plus Software Platform to manage per diem effectively.

By implementing an automated, GPS-based solution, you can navigate economic uncertainties and maximize tax savings for your fleet and drivers.

Amid economic uncertainty, mastering per diem boosts fleet financial stability. Remember, it's not just about cost savings but also boosting driver pay, retention and enhancing your overall operation. 🌟

Optimizing your fleet's per diem management isn't just about savings; it's a powerful way to navigate economic challenges, boost driver pay, and secure your financial stability. With tools like Per Diem Plus, you can drive your fleet towards greater success in your balance sheet.

Feel free to reach out if you have more questions or need further insights into this topic. Happy driving! 🛣️

At Per Diem Plus, we understand the significance of efficiency when it comes to per diem tracking and payroll reporting for truck drivers and fleets. That's why we've made automation a cornerstone of our platform.

Streamlined Per Diem Tracking: With Per Diem Plus, the days of manual calculations and ELD backups are long gone. Our automated system ensures that per diem tracking is a breeze. Truck drivers can focus on the road, not record keeping. It's accuracy without the effort.

Real-Time Compliance: Our automation doesn't stop there. We keep you in compliance with the latest IRS regulations in real-time. No more worrying about keeping up with changing rules - our system does it for you.

The Power of Time: By automating per diem tracking and payroll reporting, we give you the gift of time. Time to focus on what truly matters for your business, and time to ensure your drivers are getting the reimbursements they deserve.

With Per Diem Plus, you're not just getting a tool; you're getting a solution that transforms your per diem process. Say goodbye to the tedious and hello to the efficient. Make the smart choice today and experience the difference that automation can make.

Mark W. Sullivan, EA, the founder of Sullivan Consulting, established the firm's roots in St. Louis, MO, in 1998. In 2020, he made a strategic move to the thriving business environment of Arizona. Mark specializes in the intricate realm of federal tax controversy representation, appeals, and consulting, catering not only to individuals and businesses but also extending his expertise to renowned law and accounting firms nationwide.

Mark's distinguished career includes serving as a consulting and expert witness in a multitude of civil and criminal cases, spanning several federal district courts. His credentials are underscored by an unlimited Enrolled Agents license, a testament to his exceptional knowledge and unwavering commitment to his craft. His recognition by the Internal Revenue Service for admission to practice is grounded in his extensive background as a Revenue Officer, having worked in demanding locations such as New York, NY, St. Louis, MO, and Washington, D.C.

Mark's extensive experience as a Revenue Officer has uniquely positioned him to navigate the intricate landscape of federal tax matters. Now, based in Scottsdale, AZ, Mark continues to offer his expertise to clients across the nation, ensuring that their interests are diligently and professionally represented.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

IR-2023-193

WASHINGTON – As part of a larger effort to protect small businesses and organizations from scams, the Internal Revenue Service today announced the details of a special withdrawal process to help those who filed an Employee Retention Credit (ERC) claim and are concerned about its accuracy.

This new withdrawal option allows certain employers that filed an Employee Retention Credit claim but have not yet received a refund to withdraw the claim. Employers that submitted an ERC claim can withdraw their claim and avoid the possibility of getting a refund for which they’re ineligible.

Who can ask to withdraw an ERC claim

Employers can use the ERC claim withdrawal process if all of the following apply:

Taxpayers who are not eligible to use the withdrawal process can reduce or eliminate their ERC claim by filing an amended return. For details, see the Correcting an ERC claim – Amending a return section of the frequently asked questions about the ERC.

How to withdraw an ERC claim

To take advantage of the claim withdrawal procedure, taxpayers should carefully follow the special instructions at IRS.gov/withdrawmyERC, summarized below.

Should fax withdrawal requests to the IRS using a computer or mobile device.

The IRS has set up a special fax line to receive withdrawal requests. This enables the agency to stop processing before the refund is approved. Taxpayers who are unable to fax their withdrawal can mail their request, but this will take longer for the IRS to receive.

Employers who have been notified they are under audit:

Those who received a refund check, but haven’t cashed or deposited it, can still withdraw their claim. They should mail the voided check with their withdrawal request using the instructions at IRS.gov/withdrawmyERC.

Upcoming webinar and other resources for help

Tax professionals and others can register for a Nov. 2 IRS webinar, Employee Retention Credit: Latest information on the moratorium and options for withdrawing or correcting previously filed claims. Those who can’t attend can view a recording later.

This tax credit program that was poorly designed by Congress at the outset. Creating an escape route for taxpayers who fell victim to ERC scammers is a prudent response by the IRS. The ability to withdraw an ERC claim should eliminate thousands of unnecessary audits and criminal prosecutions for a

Do you need assistance in filing an ERC withdrawal? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO. He relocated to Scottsdale, AZ in 2020 and specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Additional references:

IRS Newswire Issue Number: IR-2023-193