PDP For Fleets - 3 Months Free

Thirty-eight states have noteworthy tax law changes taking effect on January 1, 2023. The good news is that most of the changes are lowering income tax bills for taxpayers. However, the end of temporary gas tax holidays and introduction of new excise and sales taxes will offset the income tax savings for residents in many states.

Use the Tax Foundation's interactive state-by-state analysis to explore the tax changes in your state.

Have a tax question? Contact Mark W. Sullivan, EA or request a free consultation HERE

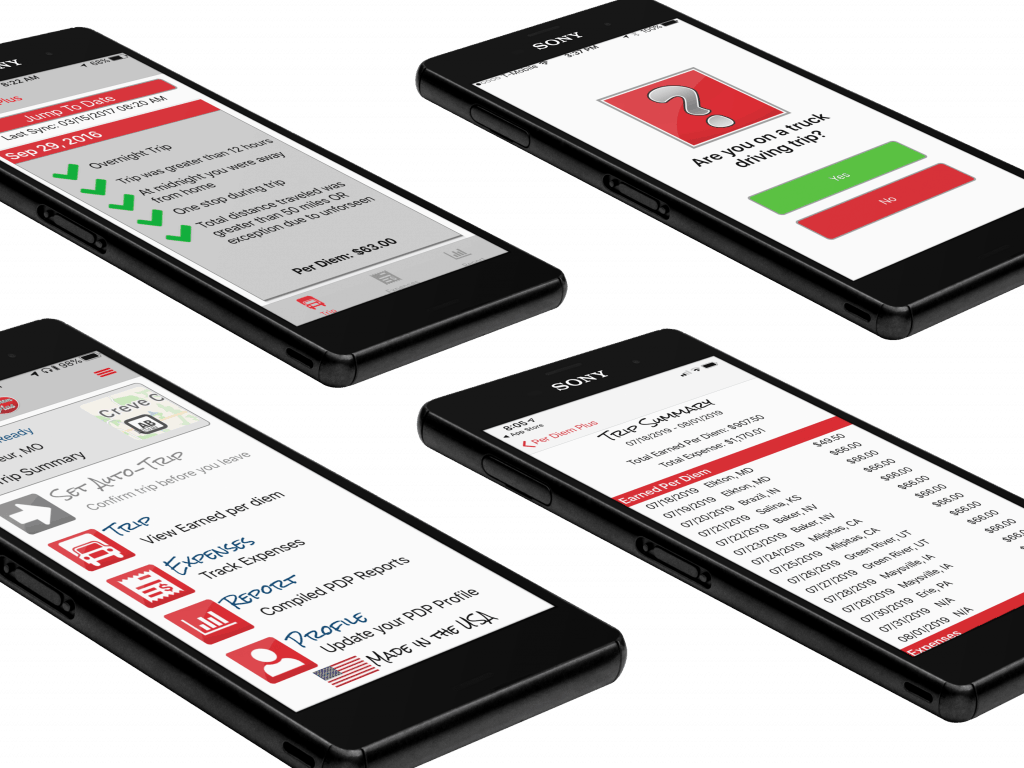

Available as a $7.99 monthly subscription on Google Play and App Store

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

"Can I use my dog as a tax deduction" is a common questioned posed to tax professionals by long-haul truckers. Every pet owner claims their animal is a member of the family and they are an essential companion for thousands of truckers. The emergence of the "Emotional Support" registration industry reinforces this fact.

It understandable that taxpayers may want to recoup some of their pet expenses with a creative medical expense tax deduction[i]. To counter the urge to claim Fido as a tax deduction the IRS has promulgated guidance on what type of animals qualify.

A review of IRC § 213 is required to answer the question, "Can I use my dog as a tax deduction?". The costs of buying, training, and maintaining a service animal to assist an individual with mental disabilities may qualify as medical care if the taxpayer can establish that the taxpayer is using the service animal primarily for medical care to alleviate a mental defect or illness and that the taxpayer would not have paid the expenses but for the disease or illness.

IRS Chief Counsel Note: A taxpayer who claims that an expense of a peculiarly personal nature is primarily for medical care must establish that fact. The courts have looked toward objective factors to determine whether an otherwise personal expense is for medical care:

A personal expense is not deductible as medical care if the taxpayer would have paid the expense even in the absence of a medical condition. Commissioner v. Jacobs, 62 T.C. 813 (1974). [ii]

You can include in medical expenses:

In general, this includes any costs, such as food, grooming, and veterinary care, incurred in maintaining the health and vitality of the service animal so that it may perform its duties.

2024 Trucker Per Diem Rates Published (September 25, 2023)

Flying With A Service Dog? Here's Everything You Need To Know (Becca Bond, The Points Guy, 9/12/23)

What Is The IRS Definition Of A Service Dog?

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

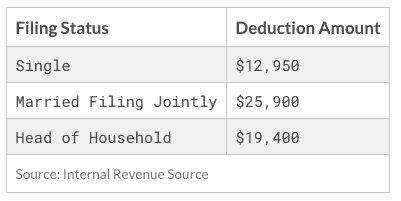

Generally, you can deduct on Schedule A, Itemized Deductions (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). However, with tax reform drastically increasing the Standard Deduction (2022: $12,950 Single, $25,900 Married) most taxpayers will not have sufficient itemized deductions to warrant pursuing a tax break for their pet expenses.

No, emotional support, therapy, comfort, or companion animals are not considered service animals under the ADA. These terms are used to describe animals that provide comfort just by being with a person. Because they have not been trained to perform a specific job or task, they do not qualify as service animals under the ADA.

"Prior to January 2021, the law allowed emotional support animals to fly with documentation from a medical doctor verifying the animal was necessary for comforting the passenger. ESAs did not have to be trained. But after rampant abuse of the system that included people taking everything from peacocks to snakes to untrained and aggressive dogs on flights, the DOT revised its regulations to allow airlines to ban ESAs from the skies. Although the ultimate decision was left up to the airlines themselves, all major U.S. and Canadian carriers quickly changed their policies to stop non-ESA pets from flying. You can still fly with a small dog (under 25 pounds), but the pup must be in a carrier and you will need to pay the airline pet fee to fly."

Becca Bond, The Points Guy (9/12/23)

Can I use my dog as a tax deduction if it guards my truck? The absence of specific guidance on guard dogs from IRS compels a taxpayer to evaluate the appropriateness of claiming a tax deduction for expenses related to a guard dog used to protect a truck that is constantly on the move as opposed to a drop-yard or terminal. Kay Bell writing for Bankrate.com provided a great analysis,

“That “Beware of dog” sign in your business’s window is no idle threat. Break-ins have stopped since you set up a place for your Rottweiler to stay overnight. In this case, the IRS would likely be amenable to business deduction claims of the animal’s work-related expenses.

Standard business deduction rules still apply, notably that the cost of keeping an animal on work premises is ordinary and necessary in your line of business. Once you show that, the dollars spent each year keeping your pooch in good guard condition — food, vet bills and training — would be deductible as a business expense.

As with all deductions, be prepared to provide full and accurate records of your animal’s hours on the job. You’ll also find your tax claim more acceptable when you demonstrate how the animal protects your livelihood inventory. In addition, as is often the case with business property, the dog must be depreciated, a way of allocating its cost over its useful life for IRS purposes.

Keep in mind, too, that your claims carry more weight when your pet is a breed that’s typically used for such jobs. So even though your Chihuahua has a loud bark, your tax claim is more credible if your guard dog is a German shepherd, Doberman pinscher or a similar imposing breed”.[iv]

Can I use my dog as a tax deduction? Maybe. Every pet owner claims their animal is a member of the family and an essential companion for thousands of long-haul truckers. The IRS disagrees. It understandable that taxpayers may want to recoup some of their pet expenses with a tax deduction, but with the overall value of the deduction is limited due to the 7.5% of AGI offsetting most expenses. Furthermore, extensive rules have been promulgated to insure only qualifying animal expenses can be deducted and taxpayers risk the wrath of the IRS if they get too creative interpreting those regulations.

Need assistance resolving a tax controversy issue? Contact Mark W. Sullivan, EA or request a free consultation HERE

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

[i] 2014 American Pet Producers Association market study

[ii]https://www.irs.gov/pub/irs-wd/10-0129.pdf

[iii]https://www.irs.gov/pub/irs-pdf/p502.pdf

[iv]https://www.bankrate.com/finance/taxes/tax-write-offs-for-pet-owners-1.aspx#slide=3

Tax season is just around the corner and the airwaves will soon be awash with ads for tax services fighting for a piece of the $168 billion income tax preparation market.

Three factors to decide whether reliance on a professional was reasonable:

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

According to recent article in the New York Post by Glenn Reynolds a recent tweet says it all.

“Sam Bankman-Fried: I don’t know where $10 billion went. The Pentagon: We don’t know where $2.2 trillion went. The IRS: You just received $601.37 on Venmo don’t forget to report it.”

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus introduces a weekly tax blog series for the 2023 tax filing season written and hosted by our tax expert, Mark W. Sullivan, EA. The posts are dedicated to simply explaining complex tax and emerging issues to help drivers minimize their income taxes. Here is a sampling of the topics to be covered:

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Mark Sullivan Consulting, PLLC; Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

2023 trucker per diem rates and tax brackets were released by the IRS in an annual bulletin, Notice 2022-44, on September 26, 2022. For taxpayers in the transportation industry the per diem rate remains unchanged form 2022 to $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section Notice 2022-44

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Help us test and develop features and functionality of our integration with Per Diem Plus Fleets for Motive (Keeptruckin) beta. Per Diem Plus® Fleets API is a configurable, ELD-integrated enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleet managers.

Truckers designed. Tax pros built it. Your drivers want it. It takes only minutes to start up an IRS-compliant per diem plan with Per Diem Plus Fleets for Motive (Keeptruckin).

Take a deep dive into the benefits of offering per diem, for both your company and drivers.

Benefits:

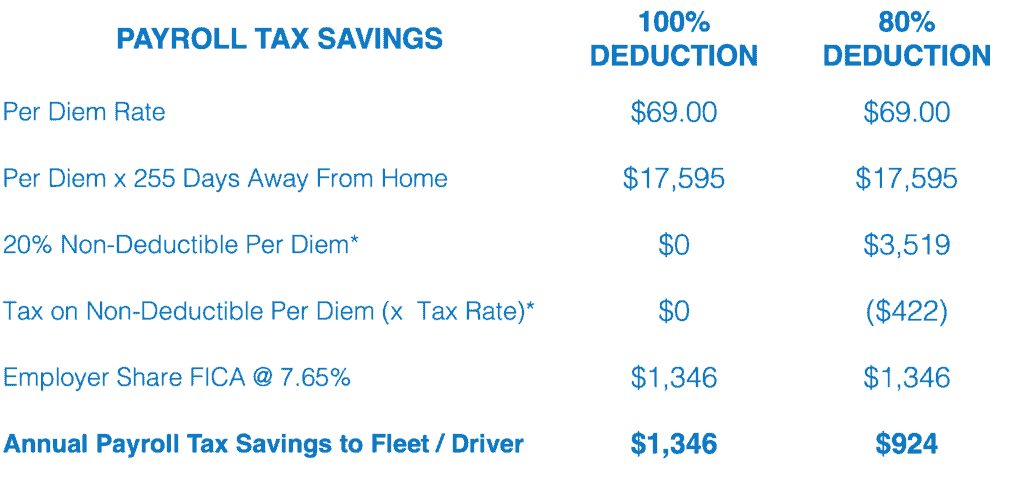

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility per diem will not save a motor carrier money. The below tables prove otherwise.

The following analysis assumes 2,500 average weekly miles / driver; $69 per diem; $75,000 annual driver wages; 255 nights away from home; a 12% effective federal income tax rate, and $10/$100 workers' comp rate.

Motive builds technology to improve the safety, productivity, and profitability of businesses that power the physical economy. The Motive Automated Operations Platform combines IoT hardware with AI-powered applications to automate vehicle and equipment tracking, driver safety, compliance, maintenance, spend management, and more. Motive serves more than 120,000 businesses, across a wide range of industries including trucking and logistics, construction, oil and gas, food and beverages, field services, agriculture, passenger transit, and delivery. Visit gomotive.com to learn more.

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of individual experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

The 2022 trucker per diem rates and tax brackets have been released. For taxpayers in the transportation industry the per diem rate increased to $69 for for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2011-47 (or successor).

IRS Orders Immediate Stop To New Employee Retention Claims (September 14, 2023)

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

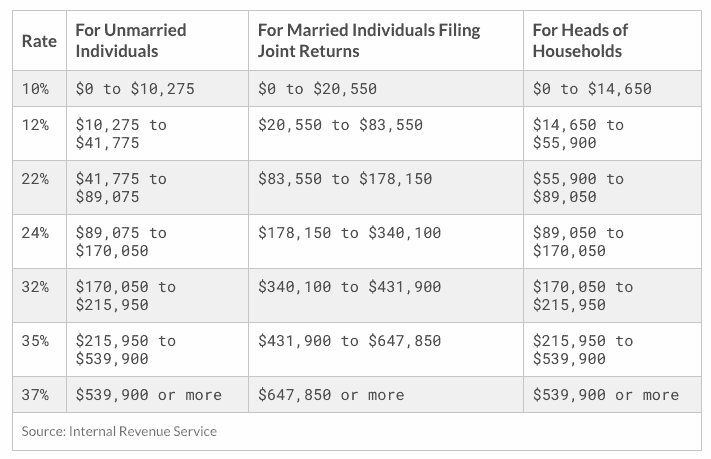

The standard deduction for single filers will increase to $12,950, $25,900 for married filing jointly, and $19,400 for head of household.

The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA)

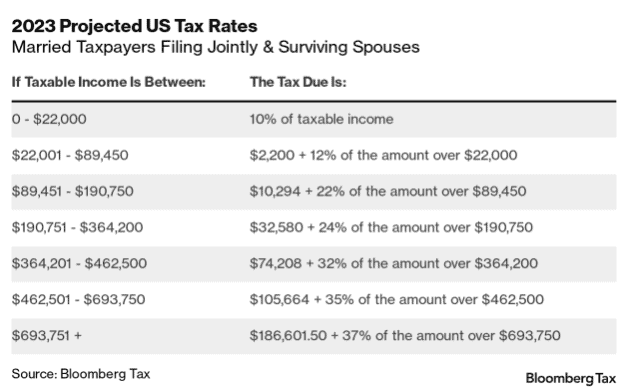

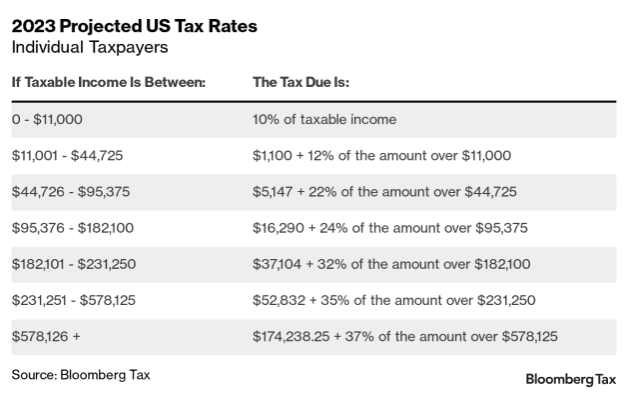

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $539,900 and higher for single filers and $647,850 and higher for married couples filing jointly.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

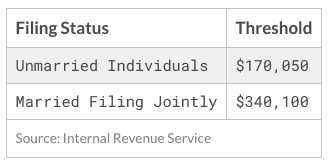

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses up to $170,050 and $340,100 for joint filers.

The maximum Child Tax Credit is $2,000 per qualifying child and is not adjusted for inflation. The refundable portion of the Child Tax Credit is adjusted for inflation and will increase from $1,400 to $1,500 for 2022.

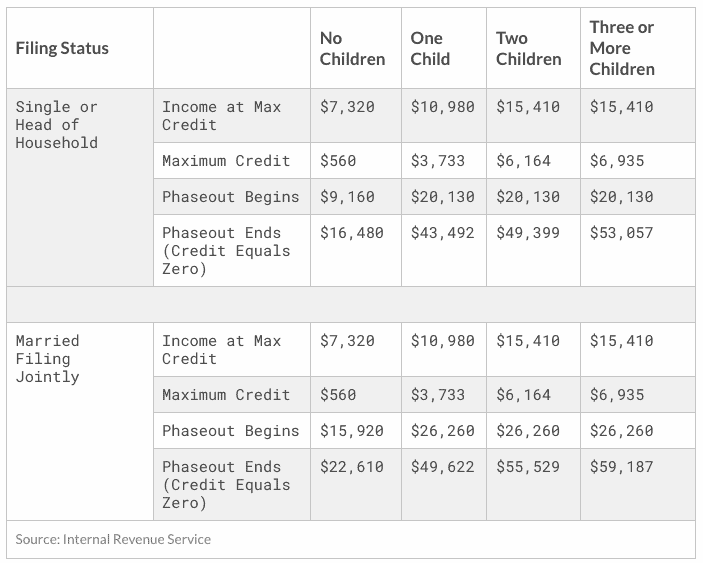

The maximum Earned Income Tax Credit (EITC) in 2022 for single and joint filers is $560 if the filer has no children (Table 5). The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Source: "2022 Tax Brackets", Erica York, Tax Foundation (11/10/21)

The 2022 special trucker per diem rates for taxpayers in the transportation industry have increased $3/day from 2020-2021 and are $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

View Notice 2021-52

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®