PDP For Fleets - 3 Months Free

In this article we attempt to clear up the confusion on the rules governing truck driver per diem in the ELD era.

Trucker per diem is a per day travel expense allowance that eliminates the need for proving actual costs for meals & incidental expenses incurred by a driver while away from home on a truck driving trip.

When did the IRS first recognize per diem for the transportation industry?

19911

When did IRS introduce the Special Transportation Industry daily rate per diem?

20002

What makes the Special Transportation Industry per diem unique?

Can all truck drivers can claim per diem as a federal tax deduction?

No. Only self-employed truckers

Can motor carriers offer per diem to employee drivers?

Yes.

IRS Issues 2024 Trucker Per Diem Rates (September 25, 2023 - IRS Notice 2023-68)

Does a driver have to spend $69 everyday?

No

What qualifies as a tax home?

Where you park your truck when home

Can a driver claim per diem if they live in their truck?

No

Can a driver or motor carrier claim per diem for lodging?

No. A receipt is required for all lodging expenses.

What are the IRS per diem substantiation requirements for trucker per diem?

Only DOT Electronic Logging Device backups or the equivalent, i.e., Per Diem Plus

What are Incidental Expenses?

Only fees and tips

Are showers & parking fees incidental expenses?

No

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount

How long should tax records be retained?

No less than 3 years

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truck drivers and fleet managers.

Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

1 TAM 9146003

2 Revenue Procedure 2000-39, 2000-9 Sec. 4.04 [Notice 2000-48].

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Help us test and develop features and functionality of our integration with Per Diem Plus Fleets for Motive (Keeptruckin) beta. Per Diem Plus® Fleets API is a configurable, ELD-integrated enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleet managers.

Truckers designed. Tax pros built it. Your drivers want it. It takes only minutes to start up an IRS-compliant per diem plan with Per Diem Plus Fleets for Motive (Keeptruckin).

Take a deep dive into the benefits of offering per diem, for both your company and drivers.

Benefits:

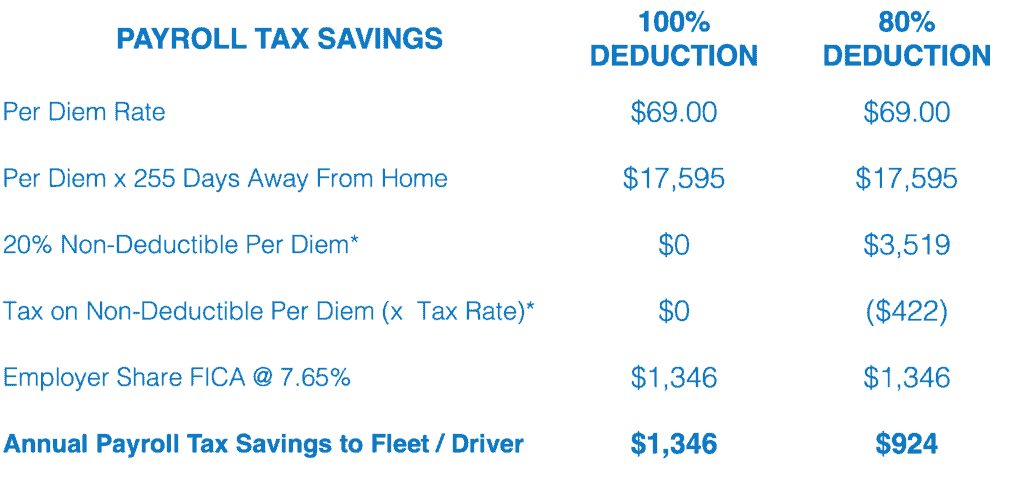

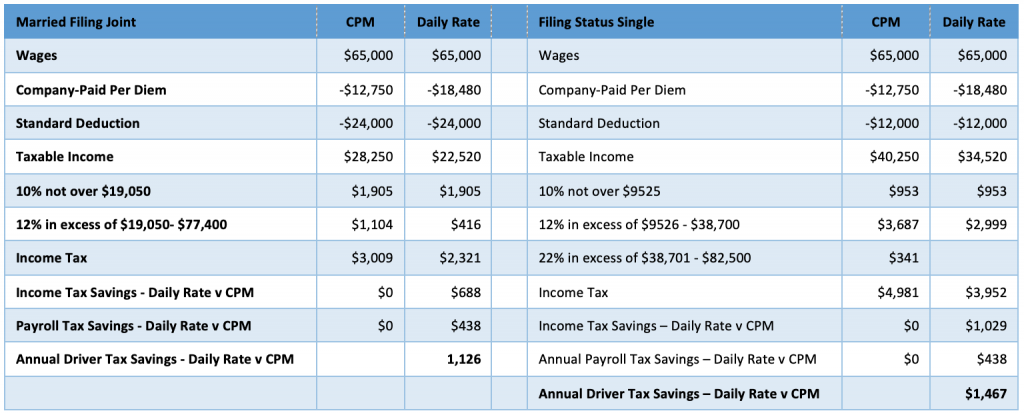

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility per diem will not save a motor carrier money. The below tables prove otherwise.

The following analysis assumes 2,500 average weekly miles / driver; $69 per diem; $75,000 annual driver wages; 255 nights away from home; a 12% effective federal income tax rate, and $10/$100 workers' comp rate.

Motive builds technology to improve the safety, productivity, and profitability of businesses that power the physical economy. The Motive Automated Operations Platform combines IoT hardware with AI-powered applications to automate vehicle and equipment tracking, driver safety, compliance, maintenance, spend management, and more. Motive serves more than 120,000 businesses, across a wide range of industries including trucking and logistics, construction, oil and gas, food and beverages, field services, agriculture, passenger transit, and delivery. Visit gomotive.com to learn more.

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of individual experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Is trucker per diem an improper wage reclassification? No, the treatment of a portion of an employee’s wages as per diem has been unique to the transportation industry for over 30 years and is not considered an improper “wage reclassification”.

The IRS first introduced per diem (per day) allowances in Revenue Procedure 90-60 - a simplified method of substantiating employee business expenses - in accordance with the Family Support Act of 1988. The first published guidance for the transportation industry was issued in 1991 where, according to the IRS, a driver's weekly compensation earned on a cents-per-mile basis may be reclassified by amounts designated as per diem (i.e. $66/day) for meals and incidental expenses after determining how many days a driver was away from home overnight [TAM 9146003].

Related Article: Part II: Is Trucker Per Diem An Improper Wager Reclassification

IRS Issues 2024 Trucker Per Diem Rates (9/25/23)

Yes. The IRS introduced the Special Transportation Industry substantiated per diem method 20 years ago in Rev. Proc. 2000-39, 2000-9 Sec. 4.04 [Notice 2000-48], which among other things:

Stay In The Know: Biden's IRS Is Coming For Your PayPal & Venmo Payments

The 2017 Tax Cuts and Jobs Act eliminated per diem as an itemized deduction on drivers individual income tax returns. As a result, interest from employees in company-sponsored per diem plans swelled as drivers sought to offset the lost deduction [about $19,000 for an average OTR driver]. Since, drivers were prohibited from using the decades-old industry standard cent-per-mile per diem method, motor carriers embraced the parity to drivers substantiated per diem provided.

Unfortunately, they discovered the IRS never published a basic instructions for implementing a substantiated per diem program or payroll process for reclassifying a portion of wages to daily rate per diem. In fact, the last comprehensive guidance issued by IRS on substantiated per diem method was Rev. Proc. 2011-47, however, it was silent on wage reclassification for per diem. So too was the last relevant court case, Beech Trucking, Inc. v. IRS (USTC 2002). The only published guidance that referenced "wage recharacterization" could be found in the Rev. Rul. 2012-25.

IRS issued Rev. Rul. 2012-25 in response to an emerging audit trend whereby businesses that did not historically offer per diem were implementing abusive per diem plans that recharacterized taxable wages as nontaxable reimbursements or allowances. Although unrelated to trucking the tax practitioner community, and especially those that offered cent-per-mile per diem audit services, elevated the ruling to misplaced prominence.

No. Based on the foregoing Rev. Rul. 2012-25 is inapplicable to transportation industry:

The employer’s cited in 2012-25 failed to fulfill the business connection requirement of the regulations because they took liberties with IRS published guidance and ignored the limitations set forth in Rev. Proc. 2011-47 Section 3.03(2) which states in part, “An allowance that is computed on a basis similar to that used in computing an employee's wages or other compensation does not meet the business connection requirement unless, as of December 12, 1989, (a) the allowance was identified by the payor either by making a separate payment or by specifically identifying the amount of the allowance, or (b) an allowance computed on that basis was commonly used in the industry in which the employee performed services.” Furthermore, neither cable contractors, nurses, construction workers or house cleaners enjoy industry-specific rules prescribed by the IRS Commissioner like those covering the transportation industry introduced in Rev. Proc. 2000-9 Section 4.04 that established the Special Transportation Industry per diem[i].

1. A truck driver employee travels away from home on business for 24 days during a calendar month. A payor pays him the $66 special trucking daily allowance for meal and incidental expenses only. The amount deemed substantiated is the total per diem allowance paid for the month or $1,584 (24 days away from home at $66 per day). The employer treats $1,584 as a pre-tax deduction; calculated withholdings; adds per diem to payroll as a non-taxable reimbursement.

2. A truck driver is paid 45 cents-per-mile. The employer classifies 10 cents-per-mile to a per diem allowance based on the number of miles driven. He travels away from home for 24 days but only drives for 20. Driver’s employer pays an allowance of $1,000 for the month based on 2500 miles per week. The amount deemed substantiated is the full $1,000 because that amount does not exceed $1,584 (24 days away from home at $66 per day). The employer calculates taxable wages at 35 cents-per-mile and per diem at 10 cents-per-mile as a non-taxable reimbursement.

Although, a driver may travel 600 miles one day but only 100 miles the next, the distance traveled does not affect the need to eat 3 meals a day. As a result, substantiated per diem accurately reflects the definition of per diem in Rev. Proc. 2011-47 section 3.01: "Paid for ordinary and necessary business expenses the payor reasonably anticipates will be incurred, by an employee for meal and incidental expenses, for travel away from home performing services as an employee of the employer." Thus, the IRS introduced the Special Transportation Industry substantiated per diem to enhance and simplify tax compliance for fleets by relying on nights away from home instead of miles traveled.

The most beneficial aspect to a driver is that:

The Internal Revenue Code gives the IRS Commissioner discretionary authority to issue regulations, such as revenue rulings and procedures, to ease the burden on taxpayers, who would otherwise have to meet the extensive substantiation requirements in order to claim deductions for business related travel. The Commissioner updates these Revenue Procedures annually, but the relevant per diem provisions have remained substantially the same since 2011.

Thirty years of IRS guidance and legislative history specifically reference an employer paying a driver in the transportation industry under the substantiated method and, therefore, contemplate that some portion of a driver’s wages will be treated as per diem. While, both the substantiated and cent-per-mile per diem methods are IRS-compliant, neither method has been considered a wage reclassification for over 30 years. However, a motor carrier that adopts the substantiated per diem method that is built into Per Diem Plus FLEETS will realize the most benefit for both the fleet and their drivers.

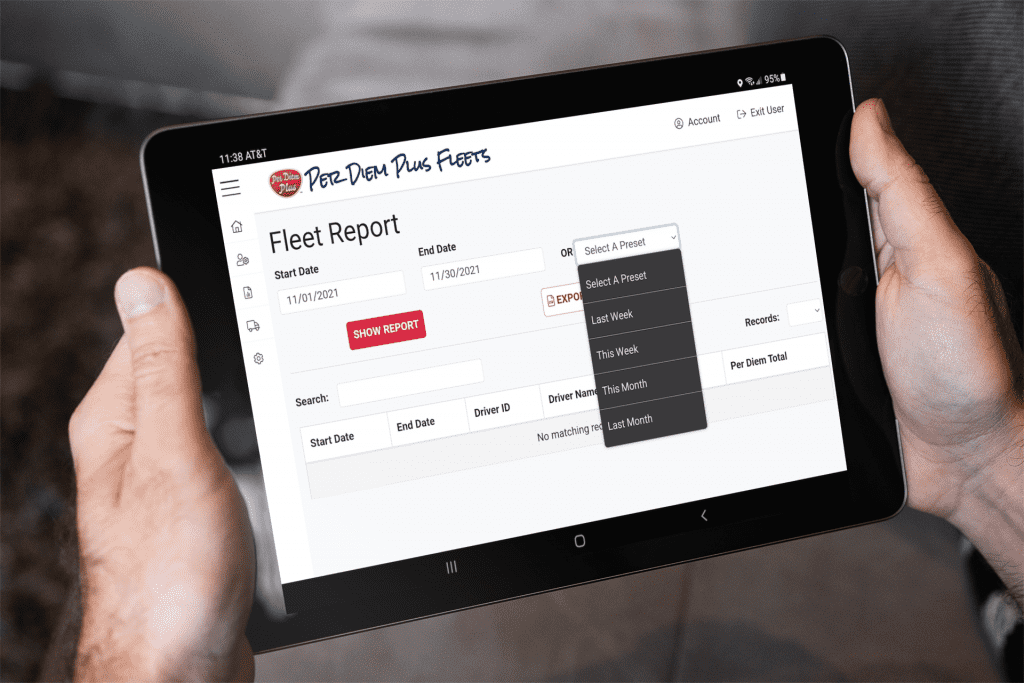

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Per Diem Plus FLEETS is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile enabled solution that automatically tracks each qualifying day of travel in the USA & Canada for solo and team drivers and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedence or relied upon in a tax dispute before the IRS.

[i] The 2019 per diem rate for travel in the USA is $66 and $49.50 for a partial day.

ii] The IRS raised the deductible percentage of employee travel related expenses to 80% in 2008

iii] Federal Register-1989-12-12 Vol 54 Page 51038 pursuant to “Family Support Act of 1988”

[iv] Rev. Ruling 2006-56, 2006-2 CB 274

[i] Updated annually IRS Notice 2019-55, 2018-77, 2017-54, 2016-58, 2015-63, 2014-57, 2013-65, 2012-63, Rev. Proc. 2011-47, 2010-39, 2009-47, 2008-59, 2007-63, 2006-41, 2005-67, 2004-60, 2003-80, 2002-63 and 2001-47.

In this article we attempt to clear up the confusion on the rules governing truck driver per diem.

What is per diem? Trucker per diem is a per day travel expense allowance. Eliminates the need for proving actual costs for meals & incidental expenses incurred.

Do I have to spend all the per diem?

No. This is the maximum amount the IRS will let you claim on your tax return.

Who can claim trucker per diem?

Self-employed truckers who are subject to DOT HOS and who travel away from home overnight where sleep or rest is required. The Per Diem Plus mobile app software takes the guesswork out of tracking trucker per diem for OTR truckers.

Can all truck drivers receive per diem?

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot claim per diem.

What qualifies as a tax home?

Where you park your truck. Your regular place of business, or home in a real and substantial sense.

If I live in my truck, can I claim per diem?

No. A taxpayer who’s constantly in motion is a "tax turtle," or someone with no fixed residence who carries their “home” with them.

Are truck drivers allowed to claim a mileage allowance per diem?

Only fleets can use a cents-per-mile per diem. IRS’ standard mileage allowance is for use of a personal vehicle.

Can a driver claim per diem for lodging?

No. Trucker per diem is exclusively for meals and incidental expenses. You must have a receipt for all lodging expenses. A self-employed driver falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is the location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Motorola Devices

What documentation meets the IRS substantiation requirements to prove overnight travel and expense?

Only Per Diem Plus or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Unlike ELD backups, Per Diem Plus a can create an IRS-compliant itemized per diem report in seconds.

Can motor carriers pay per diem to employee drivers?

Yes. A motor carrier can offer per diem to drivers subject to DOT HOS and who travel away from home overnight where sleep or rest is required under an accountable per diem plan.

Is company-paid per diem taxable as income to an employee driver under an accountable fleet per diem plan?

No. Per diem is classified as a non-taxable reimbursement to an employee driver.

What are the current per diem rates for travel in USA & Canada?

The per diem rates for 2023 & 2024 are:

(IRS released annual update on September 25, 2023 in Notice 2023-68)

Can a driver prorate per diem for partial days of travel?

Yes. A partial day is 75% of the per diem rate.

How much per diem can I deduct on my income tax return?

A self-employed trucker can deduct 80% of per diem (100% for tax years 2021 & 2022) on their tax return.

What are Incidental Expenses?

Only fees and tips.

Are showers & parking fees incidental expenses?

No. Self-employed drivers may separately deduct expenses for: Per Diem Plus subscription, showers, reserved parking fees, mailing expenses, supplies and laundry.

Can employee drivers deduct company-paid per diem on their tax return?

No.

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount are required. You can upload and store receipts on the Per Diem Plus app and share them electronically with your tax preparer in seconds.

How long should tax records be retained?

No less than 3 years from the filing date of an income tax return. You have access to your Per Diem Plus tax records for four years.

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47 or use the Per Diem Plus app that takes the guesswork out of tax-related record keeping.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2017-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®