PDP For Fleets - 3 Months Free

Tax season is upon us, and it's time to prepare and file your tax return. But before you rush to submit your documents, it's crucial to take a step back and ensure your return is bulletproof against costly mistakes and potential IRS audits. Avoiding common filing errors by hiring a tax professional who can save you time, money, and stress in the long run.

By following these steps and exercising diligence in preparing your tax return, you can significantly reduce the likelihood of costly mistakes and IRS audits. Remember, investing time and effort in ensuring accuracy now can save you from headaches down the road. Stay proactive, stay informed, and bulletproof your tax return for a smoother filing experience.

By entrusting your tax preparation needs to us, you gain access to years of experience, comprehensive knowledge of tax laws, and a commitment to excellence in every aspect of our service. We'll work closely with you to understand your unique situation, identify opportunities for savings, and navigate any complexities with confidence.

Don't leave your financial well-being to chance. Partner with Mark Sullivan Consulting and gain peace of mind knowing that your tax return is in the hands of trusted professionals. Contact us today to schedule a consultation and take the first step toward a stress-free tax season. Let's make this year's filing process smooth, efficient, and rewarding together.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2025 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Refunds sent by mail are a popular target for check fraud

Taxpayer refund checks are being stolen from the mail, and in some cases, replacement checks are also being stolen.

While over 90% of taxpayers use direct deposit for refunds, millions still prefer paper checks.

Refunds sent by mail have become a popular target for check fraud, as reported by the Treasury Department last year.

IRS Commissioner Danny Werfel has repeatedly emphasized in public comments that direct deposit is the fastest and safest way to receive refunds.

The IRS has a process in place to replace lost or stolen checks.

The Treasury’s Financial Crimes Enforcement Network has issued alerts about a nationwide rise in mail theft-related check fraud.

The IRS is modernizing its core systems, with a significant upgrade planned to roll out next year.

With refund checks increasingly becoming a target for fraud, the safest way to receive a refund is through direct deposit. While the IRS is working on improvements, taxpayers should act now to protect their refunds from theft.

Mark Sullivan Consulting assists taxpayers who have fallen victim to refund fraud, providing expert guidance through the IRS refund replacement process. Our team will navigate the complexities of filing refund traces, working with the Treasury Department, and ensuring your case is handled promptly. With years of experience in federal tax controversy, we are dedicated to securing the refunds our clients rightfully deserve while protecting them from further fraud risks. Let us advocate on your behalf and restore your peace of mind.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2025 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Additional references: "Millions of Dollars in Tax Refund Checks Are Getting Stolen", Ashlea Ebeling, The Wall Street Journal (October 4, 2024)

2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

2025 trucker per diem rates were released by the IRS in an annual bulletin, Notice 2024-68, on September 20, 2024.

For taxpayers in the transportation industry the per diem rate remains unchanged form 2022 to $80 from $69 for any locality of travel in the continental United States (CONUS) and $86 from $74 for any locality of travel outside the continental United States (OCONUS), i.e Canada.

Effective Date: This notice is effective for per diem allowances for meal and incidental expenses, that are paid to any employee on or after October 1, 2024, for travel away from home on or after October 1, 2024.

Note: A motor carrier fleet or owner operator can continue to use the 2024 per diem rate of $69 / $74 until December 31, 2024.

See Notice 2024-68

Have questions about trucker per diem? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Copyright 2024 Mark Sullivan Consulting, PLLC.

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

The IRS is ramping up its audit rates for large corporations, complex partnerships, and multimillionaires, thanks to a substantial funding boost from the Biden administration. By 2026, audit rates for corporations with over $250 million in assets will nearly triple, while complex partnerships and high-income individuals will also see significant increases. Despite these changes, the IRS reassures that individuals and small businesses earning under $400,000 won't face increased audit rates. This new focus underscores the importance of robust tax compliance and expert guidance.

Massive Funding Boost

Increased Audit Rates for Corporations

Focus on Complex Partnerships

Targeting Wealthy Individuals

Assurance for Lower-Income Entities

Audit Process

Discrepancies can lead to:

This detailed audit plan reflects the IRS's enhanced capacity to scrutinize high-value entities, backed by significant federal support.

To navigate the increasing scrutiny and complex tax landscape, retaining Mark Sullivan Consulting is essential. Our expertise in IRS audits and tax controversy will ensure your interests are protected. With personalized strategies and a deep understanding of federal tax laws, we provide unparalleled support and peace of mind. Trust us to be your steadfast ally in all tax matters.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Additional References: "The IRS says audits are about to surge — here’s who’s most at risk" Shannon Thayler, New York Post (May 3, 2024)

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Hey there, tax-savvy pals! Ever wondered if your trusty four-legged friend could actually help you fetch some a tax deduction on your tax return? Well, let's dive into the world of guard dogs and their potential impact on your taxes.

Picture this: your business has that intimidating "Beware Of Dog" sign on the window. Break-ins? Zilch since your Rottweiler moved in. So, can you actually claim a tax deduction for your guard dog's expenses? The IRS might just say yes!

But, as always, standard business deduction rules apply. Your dog's presence and the expenses associated with it must be ordinary and necessary for your line of business. If you can prove that, then the costs of keeping your loyal guardian well-fed, healthy, and trained can be deducted as a legitimate business expense.

Oh, and breed matters, too! Your tax claim gains more credibility if your guard dog is a formidable breed like a German shepherd, Doberman pinscher, or something similarly imposing. Sorry, Chihuahua, but your bark may not cut it for the IRS.

In a nutshell, while you can't exactly claim your dog as a tax deduction (no matter how loyal and fierce they are), you can potentially deduct the expenses associated with their "guard dog" role if you meet all the necessary criteria.

So, there you have it, folks. Guard dogs - not just your business's best friend, but potentially your wallet's best friend too! 🐕💰

Remember, it's always wise to consult with a tax professional to ensure you're on the right track. Stay pawsitive, and keep those business premises safe! 🐾

Do you need assistance with tax analysis and consulting? Request a free consultation HERE with Mark W. Sullivan, EA

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Navigating Tax Time: Tips To Avoid Common Pitfalls & Maximize Savings

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Why choose Mark Sullivan Consulting, PLLC? As high-income taxpayers navigate the complexities of addressing unfiled tax returns and potential IRS settlements, it's essential to seek expert guidance and support. Mark Sullivan Consulting stands ready to assist in this critical process. With years of specialized experience in federal tax controversy, audit, and appeals representation, as well as tax consulting and advisory services, Mark offers unparalleled expertise and dedication to client success.

By retaining Mark Sullivan Consulting, high-income taxpayers can benefit from personalized guidance tailored to their unique financial situations and tax challenges. From preparing unfiled tax returns to negotiating settlements with the IRS, Mark Sullivan Consulting provides comprehensive support every step of the way. With a commitment to integrity, transparency, and excellence in service, Mark Sullivan Consulting empowers clients to navigate IRS compliance initiatives with confidence and peace of mind.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

Navigating Tax Time: Tips To Avoid Common Pitfalls & Maximize Savings

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Tax season can be a stressful time for many Americans, but with a little knowledge and preparation, you can navigate it with confidence. Here are some practical tips to help you avoid common pitfalls and maximize your tax savings.

In conclusion, while tax season may seem daunting, taking proactive steps to understand your tax obligations and opportunities can lead to significant savings. Whether you're filing your taxes independently or with the help of a professional, attention to detail and awareness of potential pitfalls are key. By staying informed and organized, you can navigate tax time with confidence and optimize your financial outcomes. Remember, every dollar saved in taxes is a dollar that can contribute to your future financial security.

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Struggling to find a tax accountant these days? The accounting industry lost 300,000 professionals since COVID began. Mark Sullivan Consulting, PLLC is adding income tax preparation services in response to taxpayer demand.

Embark on this journey with Mark Sullivan Consulting as we launch our new income tax preparation services. Let us take the complexity out of taxes, allowing you to thrive personally and in your business endeavors. Cheers to a seamless tax season ahead!

Learn more at info@marksullivanconsulting.com or schedule a FREE 30-minute consultation with Mark Sullivan HERE

Mark W. Sullivan, EA founded Sullivan Consulting in 1998 in St. Louis, MO and relocated to Scottsdale, AZ in 2020. He specializes in federal tax controversy representation, appeals and consulting on behalf of individuals, businesses, law, and accounting firms nationwide. In addition, he has served as the consulting and expert witness in numerous civil and criminal cases in multiple federal district courts.

Mark has an unlimited Enrolled Agents license and is admitted to practice before the Internal Revenue Service based on his extensive experience as a Revenue Officer in New York, NY, St. Louis, MO and Washington, D.C..

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Copyright 2024 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

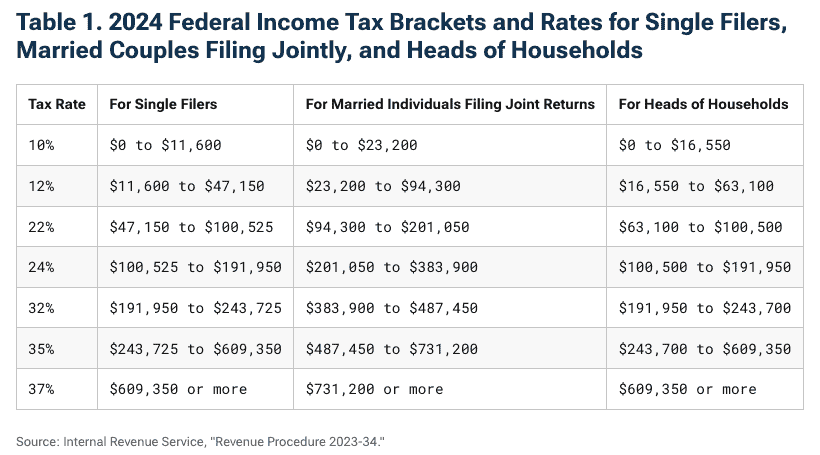

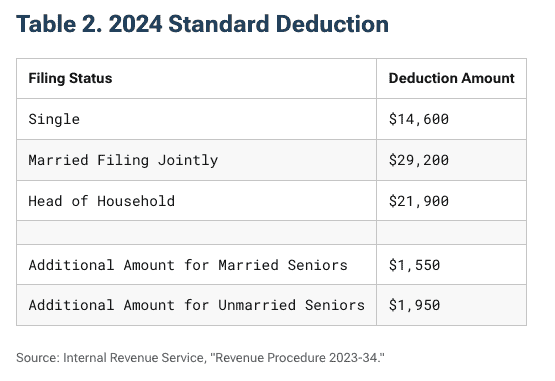

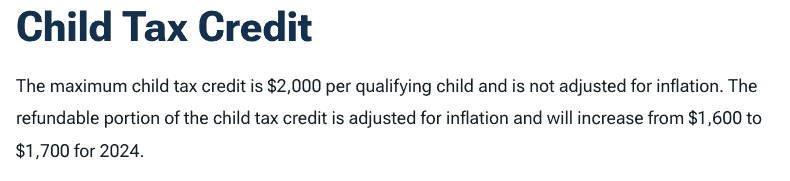

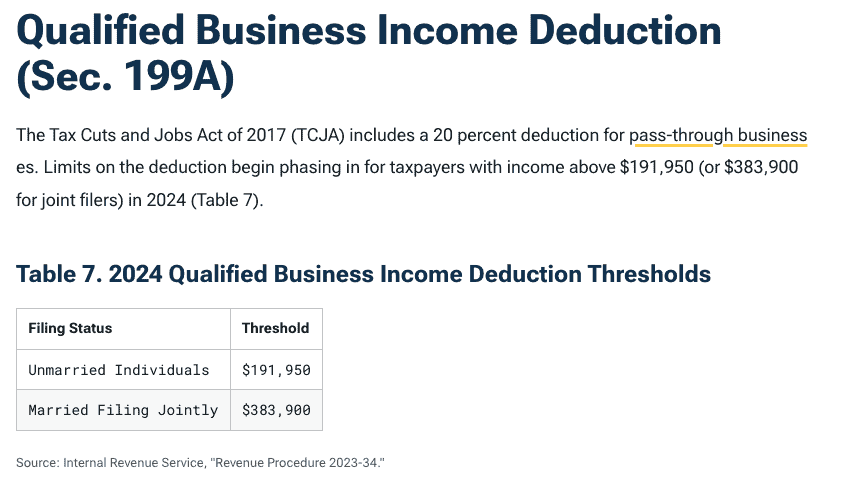

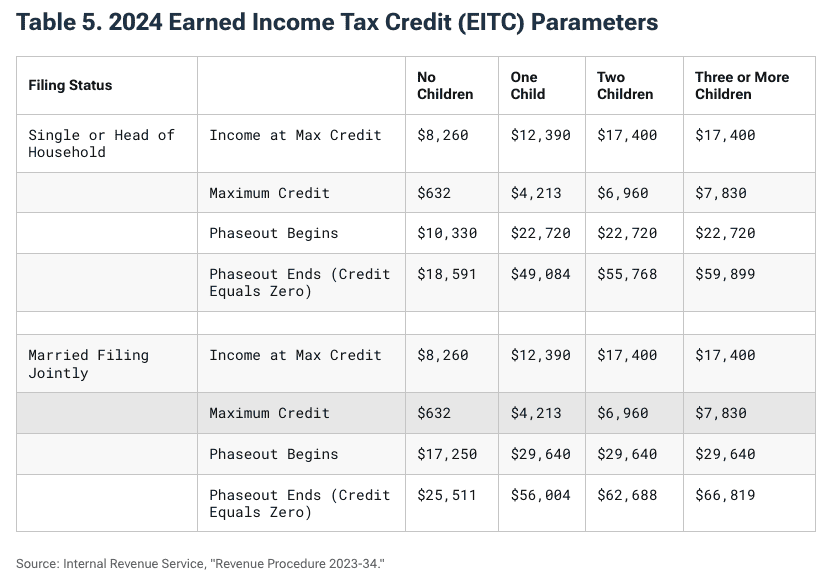

2024 trucker per diem rates and tax brackets were released by the IRS in Revenue Procedure 2023-34. For detailed information, please refer to the Tax Foundation.

For taxpayers in the transportation industry who are subject to DOT HOS the per diem rate remains unchanged from 2023 at $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS), i.e. Canada.

Mark Sullivan Consulting Launches New Income Tax Services For Truckers

IRS Orders Immediate Stop To New Employee Retention Credit Claims (IRS Newswire, 9/14/23)

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Per Diem Plus Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Source: "2024 Tax Brackets", Alex Durante, Tax Foundation (November 8, 2023)