PDP For Fleets - 3 Months Free

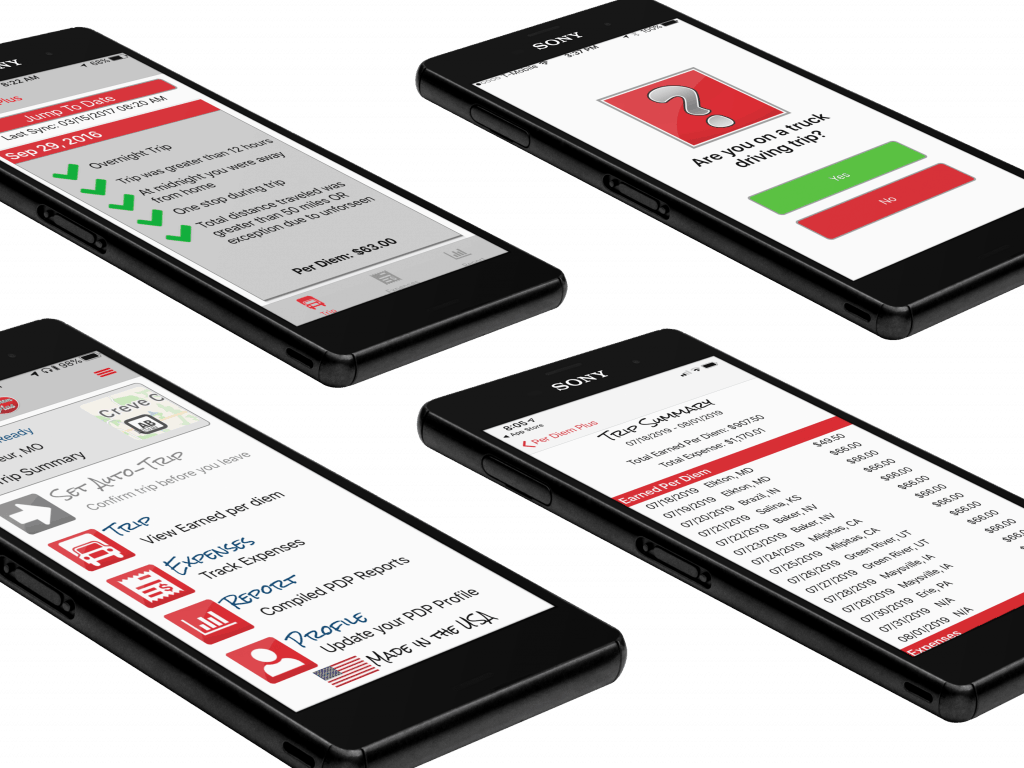

Per Diem Plus Releases Samsara Driver App. The leader in mobile-enabled transportation per diem solutions today announced the release of the Samsara Driver App. The web-based portal enables drivers to view per diem on their personal mobile device. This feature was developed in response to feedback from fleet managers to enhance per diem data visibility for drivers using Per Diem Plus Fleets API for Samsara, the pioneer of the Connected Operations Cloud. Per Diem Plus Fleets is available to all fleets on the Samsara App Marketplace.

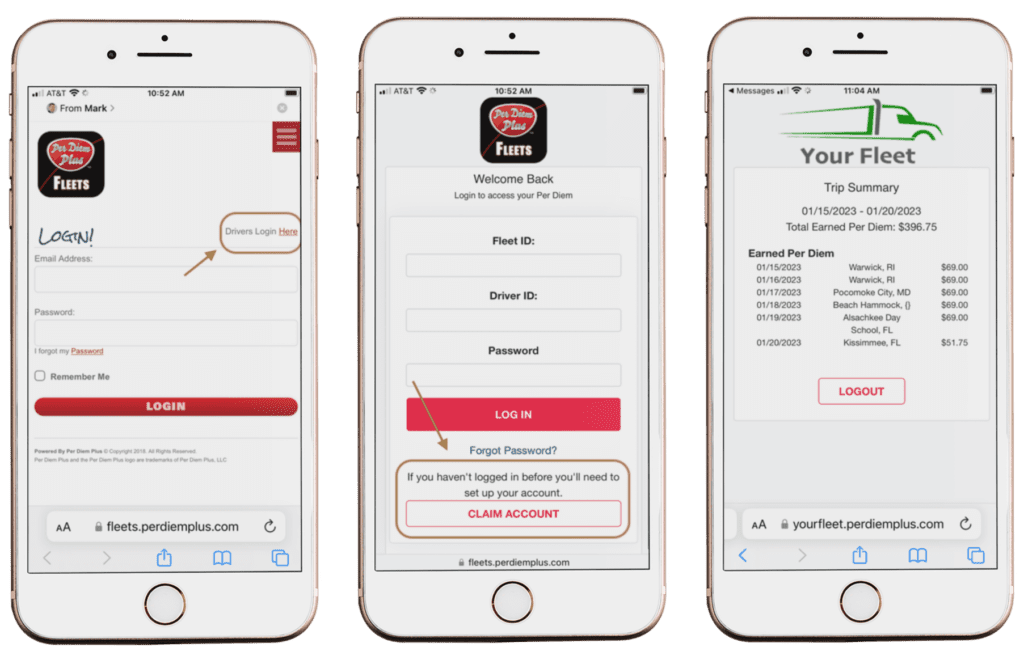

Initial driver login steps:

You only must register once

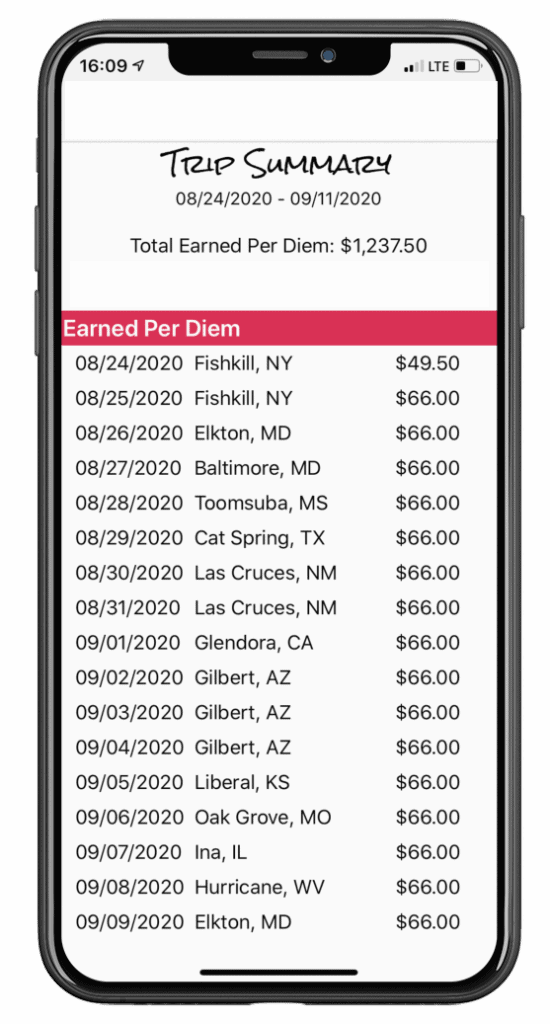

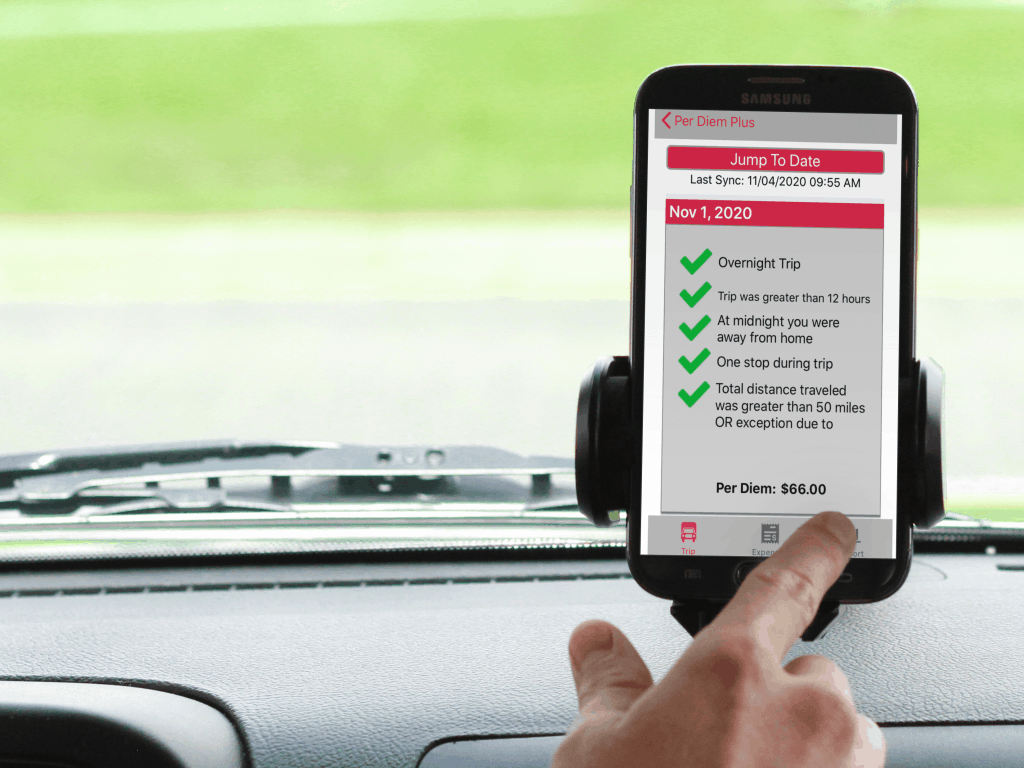

The Trip Summary list earned per diem for the current payroll period and includes the date, place and amount of per diem.

The Per Diem Plus Fleets API adapter was developed in response to growing industry demand to build integrations and PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA. It is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

SAN DIEGO, CA and CLAYTON, MO, June 7, 2022– Per Diem Plus, the leader in mobile-enabled transportation per diem solutions, and Platform Science, a leading connected vehicle platform, today announced a new collaboration making the Per Diem Plus Fleets mobile app available as part of Platform Science’s industry-leading marketplace of solutions. The Per Diem Plus app enables motor carriers to automate trucker per diem tracking, payroll accounting, administration, and auditing. Platform Science's innovative transportation solutions make it easier for fleets to develop, deploy, and manage mobile devices and applications on commercial vehicles.

“Per Diem Plus adds to our growing number of driver-focused apps that give fleets choice and flexibility, and it represents the type of solution that fleet operators are seeking to increase efficiencies and decrease burdensome tasks for drivers,” said Joe Jumayao, VP of Business Development, Platform Science. “This new collaboration with Per Diem Plus offers fleets another solution to boost productivity and meet compliance requirements. Fleet operators can use this app in conjunction with other tools in the Platform Science catalog, providing the flexibility to tailor their in-cab platform to best fit the fleet’s needs.”

Per Diem Plus utilizes GPS to establish IRS-required “time, date and place” substantiation to prove away-from-home travel for over-the-road truck drivers. It is the only IRS-compliant solution for Special Transportation Industry per diem for solo and team drivers traveling in the USA and Canada.

The benefits of the Per Diem Plus app include:

"The Per Diem Plus for Platform Science was developed in response to growing industry demand to build integrations and is a part of our continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions", said Donna Sullivan, CEO at Per Diem Plus.

About Platform Science

Platform Science is transforming transportation technology by empowering enterprise fleets with a unified, user-friendly technology platform. Platform Science makes it easy to develop, deploy and manage mobile devices and applications on commercial vehicles, giving fleets an edge in efficiency, flexibility, visibility and productivity. The customizable platform delivers an unlimited canvas to fleets and developers seeking to innovate and create new solutions as customers' needs, businesses and industries evolve. Platform Science was named by Fast Company as one of the World’s Most Innovative Companies for 2022. In 2021, Platform Science was ranked #2 in the FreightTech 25 Awards by industry news leader, FreightWaves. For more information, please visit www.platformscience.com

About Per Diem Plus

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets, and their accounting professionals. The Per Diem Plus® Fleets enterprise platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed, and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The ability of Per Diem Plus to calculate 8,892 partial per diem days yielded one customer $460,000 of additional per diem

Beware: How inadequate per diem solutions can rob you of savings. A recent New York Post article acutely observed that the Producer Price Index, the most useful measure of general inflation, was up a whopping 16.3% from April 2021, per the Bureau of Labor Statistics. That means that roughly $1 out of every $6 that people earn has been lost to inflation in a single year. Or to put it another way, 80 minutes’ earnings out of every eight-hour day have been eaten up.1 Motor carriers that figure out how to best navigate sky-high inflation and a shrinking U.S. labor force while recruiting and retaining drivers will have a market advantage over lesser fleets when inflation decreases. The keywords: Recruiting and retention.

Introducing a fleet-sponsored driver per diem program, coupled with temporary 100% deduction for per diem in 2022, will immediately reduce a motor carrier's expenses, enhance recruiting and retention and increase driver take-home pay. Per Diem Plus® customers can implement in minutes our IRS-compliant telematics-based substantiated per diem solution, which automates trucker per diem tracking for solo and teams traveling in the USA and Canada. The Per Diem Plus API and mobile apps include the unique ability to calculate full and qualifying partial per diem days, which can substantially increase the tax savings for both fleets and drivers2.

Analyzing real-world fleet per diem data is the best method for quantifying this exceptional feature to project the financial benefit partial per diem days have for both the fleet and drivers.

Based on an automated weekly fleet per diem report, 129 or 36% of 354 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

A motor carrier that offers a $0.11/mile per diem is evaluating switching to a substantiated per diem program using the free trial of Per Diem Plus for Samsara. Based on an automated weekly beta test fleet report, 30 of 100 drivers enrolled in Per Diem Plus Fleets received at least 1 partial per diem for the week. The results:

A motor carrier must substantiate the “time, date, and place” for each day of travel. Here is how the IRS-friendly Per Diem Plus FLEETS web services portal output report handles this requirement:

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

No matter how big or small your company is, Per Diem Plus has a cost-effective solution for you.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

1 - Glenn H. Reynolds, "Why team Biden might be purposely grinding down the middle class", New York Post, May 26, 2022

2 - IRS Rev. Proc. 2011-47 6.04

3 - IRS Rev. Proc. 2011-47 6.04.2

Copyright 2017-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

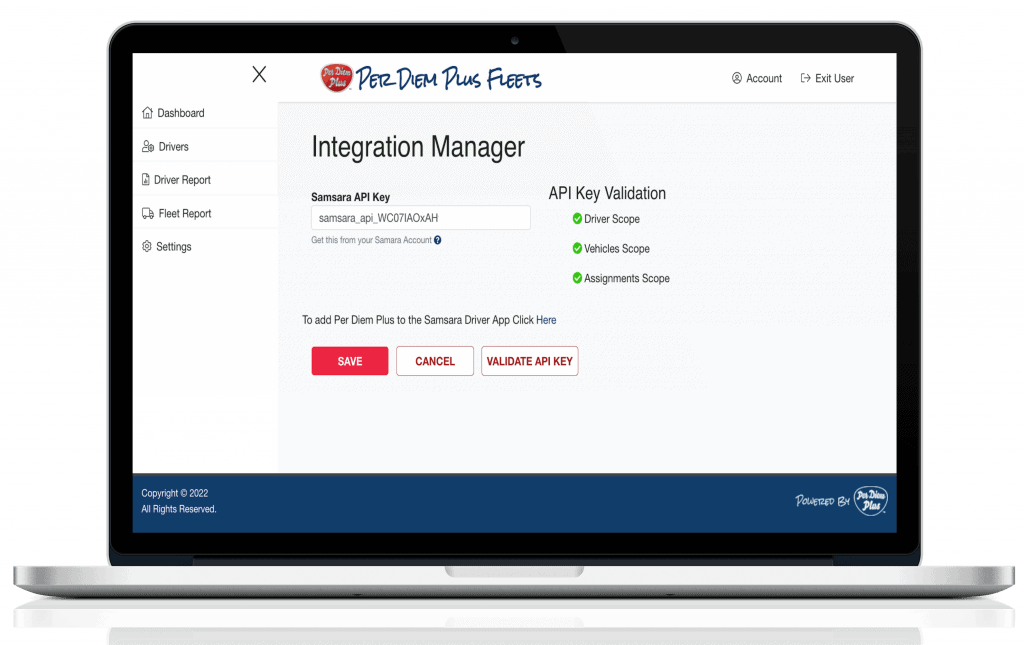

New "Check Configuration" API button added for Samsara. Why is this new feature important? Samsara recently updated their API requirements by incorporating granular scopes to the configuration of integrated solutions, like Per Diem Plus. What was previously a simple 3 step process morphed into 7 specific configuration permissions, which created issues for some motor carriers.

How does the new "Check Configuration" API button added to Samsara work? When an API access token is added to the Integration Manager it will automatically check the API Token configuration.

Our API adapter was developed in response to growing industry demand to build integrations and is a part of PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Per Diem Plus Fleets is available to all fleets on the Samsara App Marketplace.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

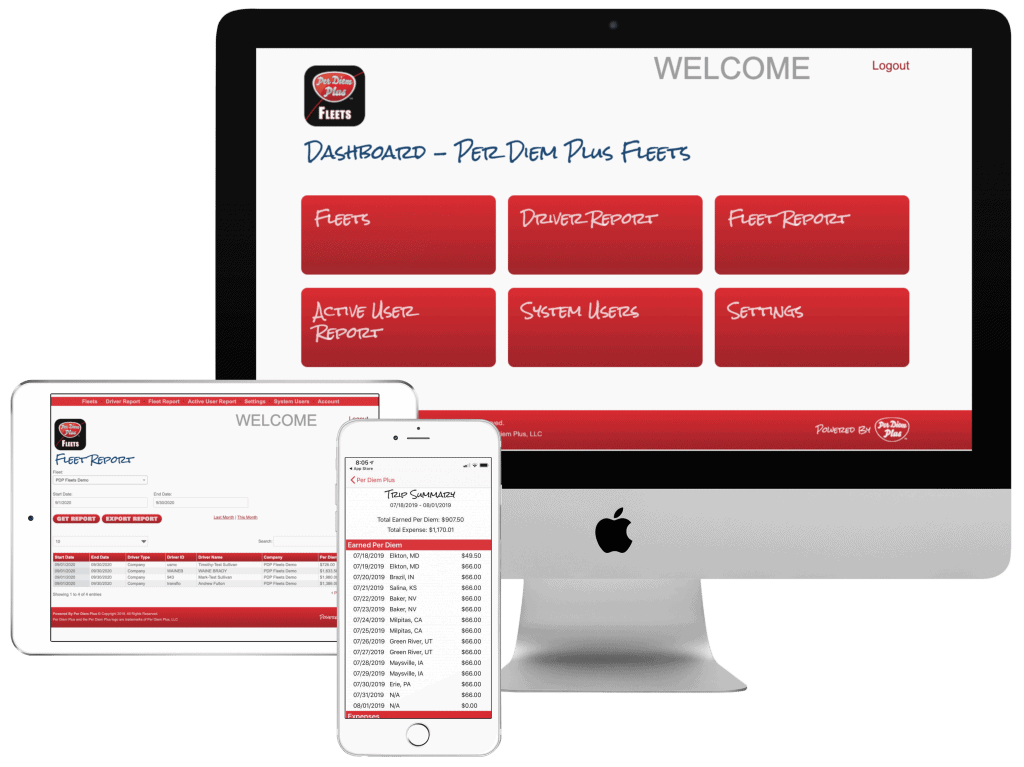

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Per Diem Plus, the leader in mobile-enabled transportation per diem solutions, today announced the release of the Per Diem Plus Fleets application programming interface (API) integration for Samsara, the pioneer of the Connected Operations Cloud. Now, Per Diem Plus Fleets will be available to all fleets on the Samsara App Marketplace.

The Per Diem Plus Fleets API adapter was developed in response to growing industry demand to build integrations and is a part of PDP’s continued strategy to improve business management practices with best-in-class, IRS-compliant per diem solutions. Fleets can seamlessly integrate PDP Fleets with Samsara’s Connected Operations Platform to automate the implementation and administration of an IRS-compliant accountable driver per diem plan for fleet managers.

Per Diem Plus completed months of beta testing in December with several motor carriers, including Intercity Lines. Jay Leno's favorite auto transport company is transitioning from the PDP Fleets mobile app to the API. "Setting up the API could not have been easier. It took us less than 5 minutes to configure the PDP Fleets API with our Samsara account," said Dean Wilson, Vice President at Intercity Lines. "Since introducing our driver per diem program in 2020 Intercity has achieved 85% driver participation, cut driver turnover by 10%, and saved over $3,000 per driver annually that was used to raise driver pay by several cents per mile," said Wilson.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves tens of thousands of customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, and food and beverage. The company's mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy at www.samsara.com.

Per Diem Plus was born over our 30 years of individual experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to easily implement an IRS-compliant fleet per diem program in hours that is scalable and data plan-friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

100% deduction for trucker per diem in COVID-19 Pandemic Relief Package confirmed by the IRS in Notice 2021-63 (12/6/2021)

[Update: The temporary 100% deduction for per diem expired on December 31, 2022]

Congress used a single line on page 4871 of the Consolidated Appropriations Act, 2021 (CAA) to allow the full deduction for per diem. Section 210 of the act temporarily raised the allowance of business meals (for food or beverages provided by a restaurant) under IRC § 274(n) to 100% from 50% for tax years 2021 and 2022.

The IRS issued Notice 2021-25 on April 8, 2021 (updated by Notice 2021-63 on December 6, 2021) that explains when the temporary 100-percent deduction applies and when the 50-percent limitation continues to apply for purposes of § 274 of the Internal Revenue Code (Code), as amended by § 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Act), enacted as Division EE of the Consolidated Appropriations Act, 2021, Pub. L. No. 116- 260, 134 Stat. 1182 (December 27, 2020)

The IRS previously allowed motor carriers and self-employed truckers using the Special Transportation Industry per diem to deduct business meals at 80% under 274(n)(3). Unfortunately, Congress omitted any commentary on the interplay of 274(n)(1) and (3) in the CAA. On April 9, 2021, I called the Office of Associate Chief Counsel (Income Tax & Accounting) and obtained confirmation the temporary 100-percent deduction for business meal expenses applied to the transportation industry as well. The Associate Chief Counsel's opinion was affirmed by issuance of IRS Notice 2021-63 on December 6, 2021.

"Absolutely yes, we tried to allow as many taxpayers to use it as possible"

Deena Devereux, IRS Office of Associate Chief Counsel

26 U.S. Code § 274 - Disallowance of certain entertainment, etc., has been revised as follows (as modified by the CAA):

(n) 100 percent of meal expenses allowed as deduction

(1) In general:

The amount allowable as a deduction under this chapter for any expense for food or beverages shall not exceed 100 percent of the amount of such expense which would (but for this paragraph) be allowable as a deduction under this chapter.

(2) Exceptions

Paragraph (1) shall not apply to any expense if—

(A) such expense is described in paragraph (2), (3), (4), (7), (8), or (9) of subsection (e),

(B) in the case of an employer who pays or reimburses moving expenses of an employee, such expenses are includible in the income of the employee under section 82, or

(C) such expense is for food or beverages— (i) required by any Federal law to be provided to crew members of a commercial vessel,(ii) provided to crew members of a commercial vessel.

(D) such expense is—

(i) for food or beverages provided by a restaurant, and

(ii) paid or incurred before January 1, 2023.

(3) Special rule for individuals subject to Federal hours of service (superseded by CAA)

In the case of any expenses for food or beverages consumed while away from home (within the meaning of section 162(a)(2)) by an individual during, or incident to, the period of duty subject to the hours of service limitations of the Department of Transportation, paragraph (1) shall be applied by substituting “80 percent” for “50 percent”

Motor Carrier: A motor carrier with an effective Federal tax rate of 10% paying trucker per diem to a driver who is away from home an average 280 nights per year will save with the full deduction for per diem an additional $370 per year in 2021 and 2022.

Owner Operator: An independent owner operator operating one-truck with an effective Federal tax rate of 18% claiming trucker per diem and averaging 280 nights away from home per year will save with the full deduction for per dieman additional $665 per year in 2021 and 2022.

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

The Per Diem Plus® is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2021, 2022, 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

The 2022 special trucker per diem rates for taxpayers in the transportation industry have increased $3/day from 2020-2021 and are $69 for any locality of travel in the continental United States (CONUS) and $74 for any locality of travel outside the continental United States (OCONUS). See section 4.04 of Rev. Proc. 2019-48 (or successor).

View Notice 2021-52

IRS Publishes 2024 Trucker Per Diem Rates (September 25, 2023)

Per Diem Plus is a proprietary mobile software application that was designed by truckers and built by tax pros. It is the only IRS-compliant mobile app for iOS and Android that automatically tracks each qualifying day of travel in the USA & Canada and replaces ELD backups (logbooks) to substantiate away-from-home travel.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

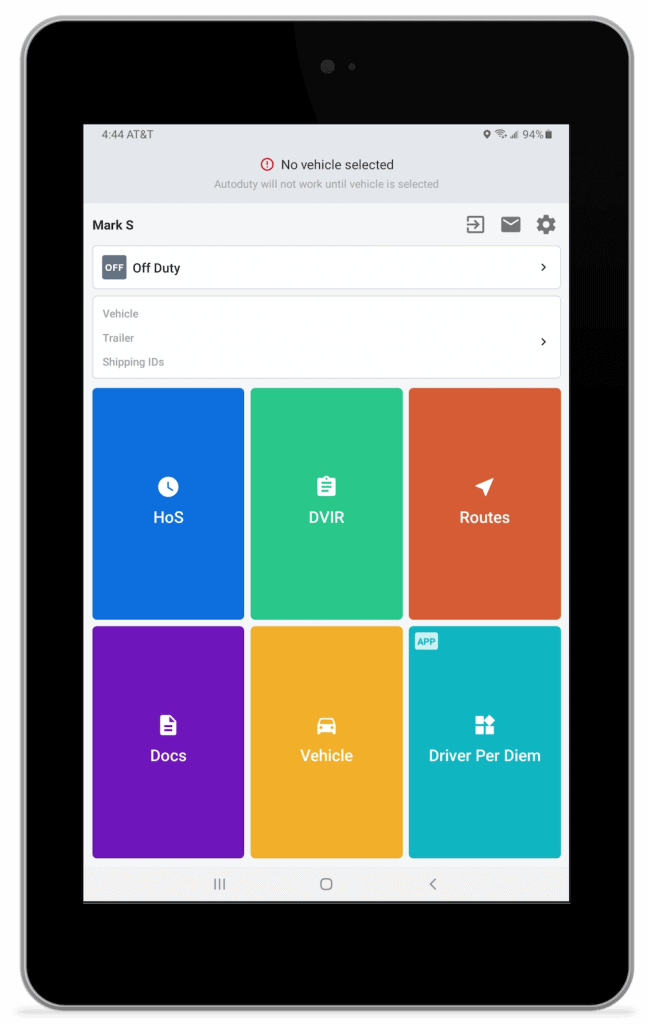

Per Diem Plus® FLEETS, a mobile application platform that automates per diem tax compliance for motor carriers, today announced a new integration with Samsara. The deep link is a configurable integration that enables drivers to navigate between the Samsara ELD dashboard and Per Diem Plus FLEETS app creating an enhanced user experience.

Related Articles

Per Diem Plus Announces New API Integration With Samsara

With over $40 million of per diem claimed and 5 years of reports accepted by the IRS, adding an accountable, substantiated per diem program is a sure-fire way for a motor carrier to increase driver take home pay and save money.

Consider the following:

Our cloud-based platform enables motor carriers to implement an IRS-compliant fleet per diem plan that is:

Case Study: One fleet with 85 company drivers was able to save $255,000 in the first year and increase driver pay by $0.04 per mile by leveraging FLEETS.

[1] The Special Trucker Per Diem rate is established by the Internal Revenue Service in an annual notice. See IRS Notice 20-70

Use our Fleet Per Diem Benefit Calculator to learn how much your fleet can save with Per Diem Plus Fleets.

Per Diem Plus FLEETS is a configurable mobile application enterprise platform that automates administration of an IRS-compliant accountable per diem plan for truck drivers and fleets managers. No matter how big or small your company is, Per Diem Plus has a solution for you.

Samsara is the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT (Internet of Things) data to develop actionable business insights and improve their operations. Samsara operates in North America and Europe and serves more than 20,000 customers across a wide range of industries including transportation, wholesale and retail trade, construction, field services, logistics, utilities and energy, government, healthcare and education, manufacturing and food and beverage. Learn more about Samsara's mission to increase the efficiency, safety, and sustainability of the operations that power the global economy at www.samsara.com

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to implement an IRS-compliant fleet per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers travelling in the United States and Canada. For more information, visit www.perdiemplus.com

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

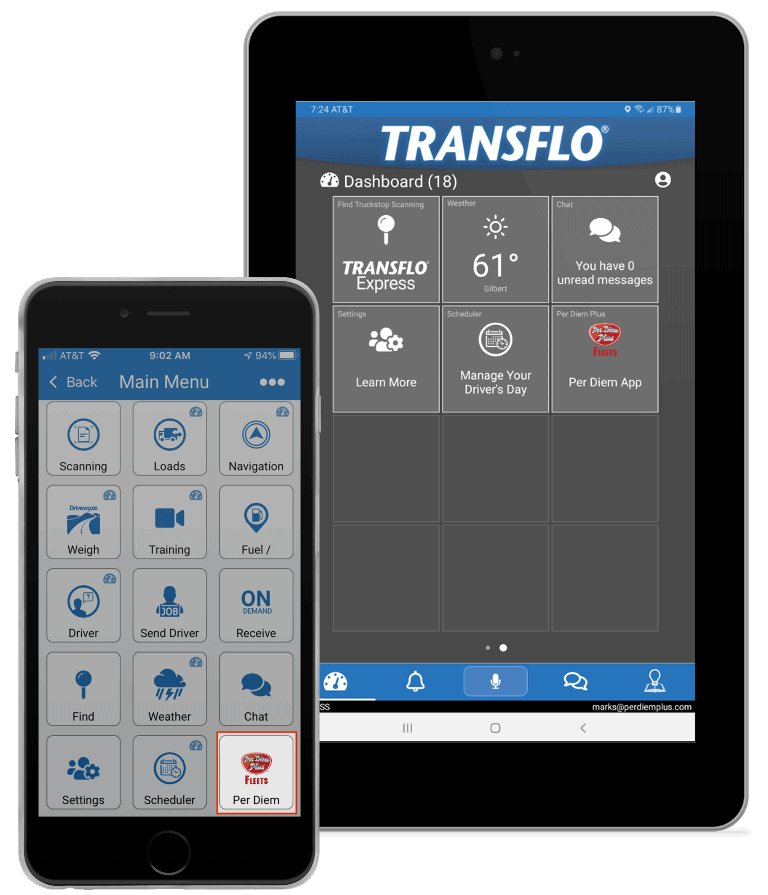

Per Diem Plus® FLEETS, a mobile application platform that automates per diem tax compliance for motor carriers, today announced a new integration with Transflo. The deep link is a configurable integration that enables drivers to navigate between the Transflo Mobile dashboard and Per Diem Plus FLEETS app creating an enhanced user experience.

With over $40 million of per diem claimed and 5 years of reports accepted by the IRS, adding an accountable, substantiated per diem program is a sure-fire way for a motor carrier to increase driver take home pay and save money. Consider the following:

Our cloud-based platform enables motor carriers to implement an IRS-compliant fleet per diem plan that is:

Case Study: One fleet with 85 company drivers was able to save $255,000 in the first year and increase driver pay by $0.04 per mile by leveraging FLEETS.

[1] The Special Trucker Per Diem rate is established by the Internal Revenue Service in an annual notice. See IRS Notice 20-70

Transflo®, a Pegasus TransTech company, is a leading mobile, telematics, and business process automation provider to the transportation industry in the United States and Canada. Transflo’s mobile and cloud-based technologies deliver real-time communications to fleets, brokers, shippers, and commercial vehicle drivers, and digitize 800 million shipping documents a year, representing approximately $84 billion in freight bills. Organizations throughout the Transflo client and partner network use the solution suite and digital platforms to increase efficiency, improve cash flow, and reduce costs. Headquartered in Tampa, Florida, USA, Transflo is setting the pace for innovation in transportation software. For more information, visit www.transflo.com.

Per Diem Plus was born over our 25 years of experience as agents and tax practitioners and a relentless pursuit to introduce efficiency to the time consuming task of tax compliance for truck drivers, fleets and their accounting professionals. The Per Diem Plus® FLEETS mobile application platform enables motor carriers to implement an IRS-compliant fleet per diem program in hours that is scalable and data plan friendly. Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for travel in the United States and Canada for drivers, motor carriers and owner operators. For more information, visit www.perdiemplus.com

Copyright 2021 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Yes. As a self-employed trucker you cannot do your job via a ZOOM meeting, thus you are eligible for a refundable tax credit under the Families First Act (FFCRA). You may fund the "sick leave" or "family leave" tax credit by using a portion of the 2020 estimated tax payments that were supposed to be paid quarterly. The refundable credit will be claimed on your Form 1040, U.S. Individual Income Tax Return, for the 2020 tax year.

An eligible self-employed individual is defined as an individual who,

Eligible self-employed individuals are allowed an income tax credit to offset their federal self-employment tax for any taxable year equal to their “qualified sick leave equivalent amount” or “qualified family leave equivalent amount.”

The tax credit is calculated by multiplying the number of days you could not work (maximum of 10 days) between April 1 and December 31, 2020 by either:

Average daily self-employment income is an amount equal to the net earnings from self-employment for the taxable year divided by 260. A taxpayer’s net earnings from self-employment are based on the gross income that he or she derives from the taxpayer’s trade or business minus ordinary and necessary trade or business expenses.

Which type of "leave" you qualify for depends on the reason(s) you were unable to work. Those that were prohibited from working can claim up to $511/day but those who were home to care for a family member can only claim up to $200/day.

For an eligible self-employed individual who is unable to work or telework because the individual:

the qualified sick leave equivalent amount is equal to the number of days during the taxable year that the individual cannot perform services in the applicable trade or business for one of the three above reasons, multiplied by the lesser of $511 or 100 percent of the “average daily self-employment income” of the individual for the taxable year.

Example: John was unable to drive due to state-mandated quarantine orders and the absence of loads for 8 days. He had $75,000 or an average of $288/day of self-employment income in 2020.

John can claim the lesser amount of $2,304 as refundable credit under FFCRA on his Form 1040, U.S. Individual Income Tax Return.

For an eligible self-employed individual who is unable to work or telework because the individual:

the qualified family leave equivalent amount is equal to the number of days during the taxable year that the individual cannot perform services in the applicable trade or business for one of the three above reasons, multiplied by the lesser of $200 or 67 percent of the “average daily self-employment income” of the individual for the taxable year.

Example: Mary was unable to drive for 10 days because she was home caring for her husband who had been exposed to COVID. She had $65,000 or an average of $250/day of self-employment income in 2020.

Mary can claim the lesser amount of $1,680 as refundable credit under FFCRA on his Form 1040, U.S. Individual Income Tax Return.

The refundable credits are claimed on the self-employed individual’s Form 1040, U.S. Individual Income Tax Return, tax return for the 2020 tax year. The Families First Act refundable tax credit is not surprisingly complicated, please consult with your tax advisor.

Substantiate the days you were unable to work using either of the following methods:

The Per Diem Plus® - Owner Operators is the only IRS-compliant mobile application that provides automatic trucker per diem and travel-related expense tracking for drivers, motor carriers and owner operators. Per Diem Plus was designed, developed and is managed in the USA.

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2020-2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

Disclaimer: This article is for information purposes only and cannot be cited as precedent or relied upon in a tax dispute before the IRS.