PDP For Fleets - 3 Months Free

In this article we attempt to clear up the confusion on the rules governing truck driver per diem in the ELD era.

Trucker per diem is a per day travel expense allowance that eliminates the need for proving actual costs for meals & incidental expenses incurred by a driver while away from home on a truck driving trip.

When did the IRS first recognize per diem for the transportation industry?

19911

When did IRS introduce the Special Transportation Industry daily rate per diem?

20002

What makes the Special Transportation Industry per diem unique?

Can all truck drivers can claim per diem as a federal tax deduction?

No. Only self-employed truckers

Can motor carriers offer per diem to employee drivers?

Yes.

IRS Issues 2024 Trucker Per Diem Rates (September 25, 2023 - IRS Notice 2023-68)

Does a driver have to spend $69 everyday?

No

What qualifies as a tax home?

Where you park your truck when home

Can a driver claim per diem if they live in their truck?

No

Can a driver or motor carrier claim per diem for lodging?

No. A receipt is required for all lodging expenses.

What are the IRS per diem substantiation requirements for trucker per diem?

Only DOT Electronic Logging Device backups or the equivalent, i.e., Per Diem Plus

What are Incidental Expenses?

Only fees and tips

Are showers & parking fees incidental expenses?

No

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount

How long should tax records be retained?

No less than 3 years

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truck drivers and fleet managers.

Per Diem Plus was designed, developed and is managed in the USA and is the only IRS-compliant mobile application that provides automatic trucker per diem for solo and team drivers traveling in the United States and Canada. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

1 TAM 9146003

2 Revenue Procedure 2000-39, 2000-9 Sec. 4.04 [Notice 2000-48].

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

The freight market has experienced steady softening over the past year while diesel prices have gained more than 40 cents from a month ago. So how can fleets mitigate softening freight rates and the exploding cost of fuel? Most fleets aren’t maximizing the tax deductible benefits of per diem, leaving thousands of dollars per driver on the table every year. Below is a guide on how best to manage this within your carrier operation, and unlock significant fleet savings while boosting driver pay amid economic uncertainty and record inflation.

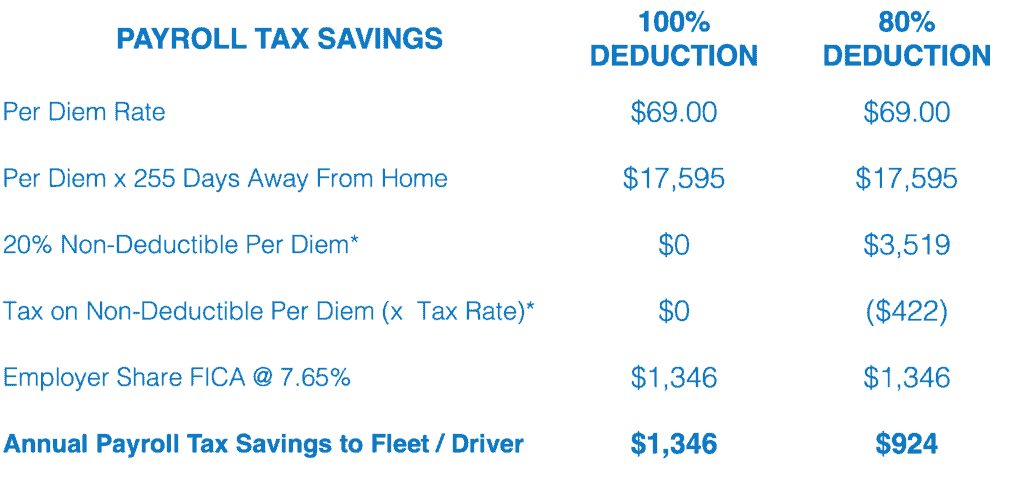

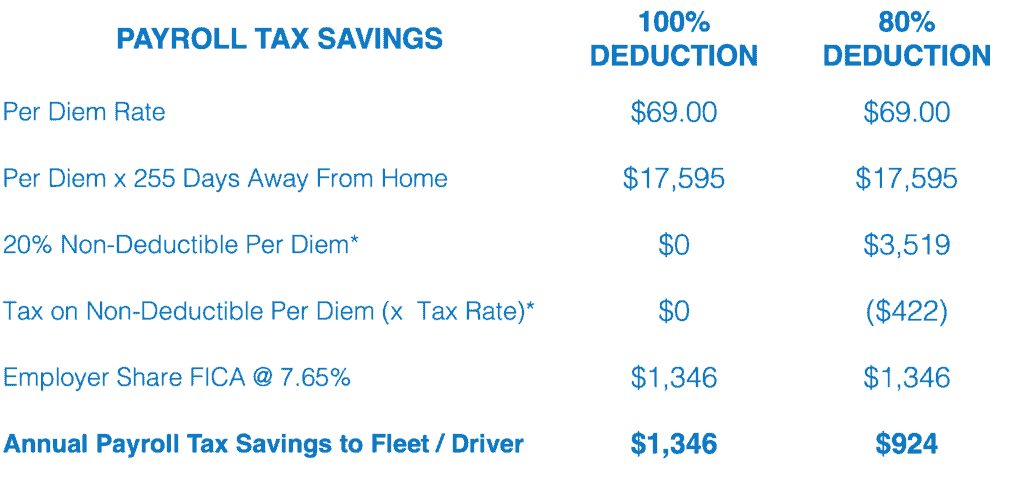

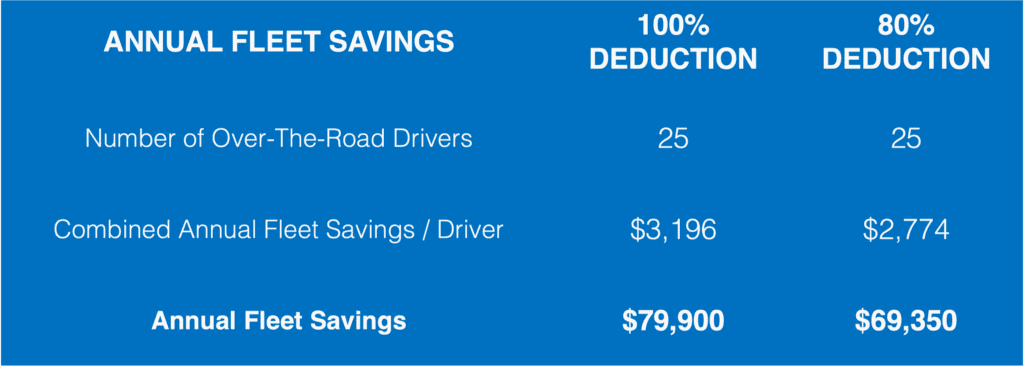

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility, per diem will not save a motor carrier money. The below tables prove otherwise.

Assumptions

The following analysis assumes:

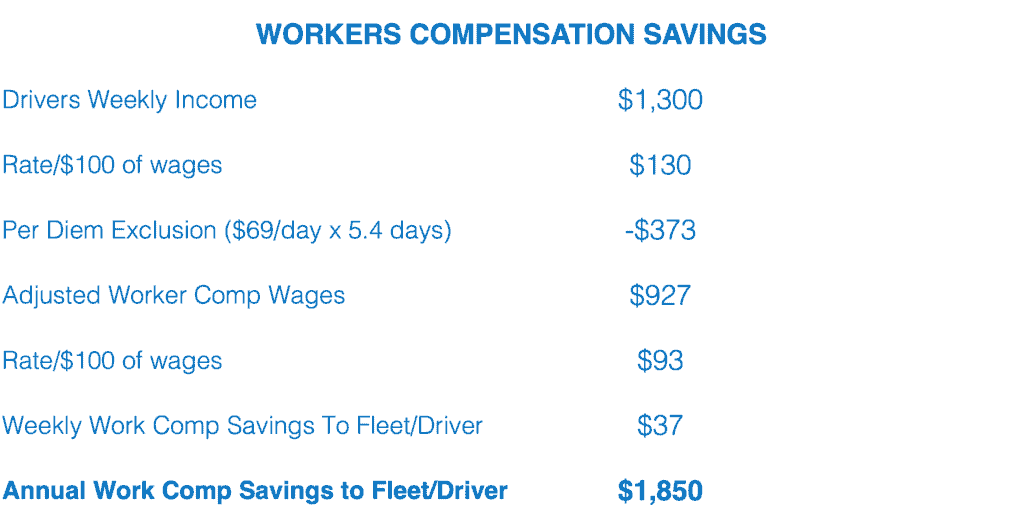

Twenty-three states are members of the National Council on Compensation Insurance (NCCI), and 39 rely on NCCI regulations. Under NCCI rules, a motor carrier paying substantiated per diem under an IRS-accountable plan can exclude up to $69/day of per diem from taxable wages, which provides a significant per driver annual savings to a fleet. (IRS Publishes 2024 Trucker Per Diem Rates)

Even with growing economic uncertainty and recessionary clouds on the horizon, Congress elected not to extend the 100% deduction for per diem. However, a motor carrier that implements an automated per diem solution will be in a stronger position to weather the economic storm.

As of January 1, 2018, employee drivers can no longer claim per diem as an itemized deduction on their federal income tax return. However, motor carriers can offer per diem to employee drivers to recapture the lost tax savings. The average Married over-the-road driver earning $65,000 annually will save approximately $3,457 in federal income taxes equivalent to $0.03 cents per mile.

The average Single over-the-road driver earning $65,000 annually will save approximately $4,485 in federal income taxes equivalent to $0.04 cents per mile.

In short, you are virtually always better off leveraging a fixed $69/day (as of this writing) to maximize your per diem tax offset from wages.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Conta

Copyright 2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

On Monday, November 21, 2022, Mark W. Sullivan, EA, Tax Counsel for Per Diem Plus hosted a webinar for the American Trucking Association titled, "Unlock Fleet Savings With Per Diem Amid Economic Uncertainty". The following are excerpts from that presentation.

The freight market has experienced steady softening over the past few months while the nationwide average price for a gallon of diesel fuel hovering around $5.36 or about $2.02 more than just one-year ago1. So how can fleets mitigate the exploding cost of fuel and softening freight rates2? Use per diem compliance tech to unlock fleet savings amid economic uncertainty and record inflation.

An automated telematic solution, like Per Diem Plus®, allows motor carriers to rapidly deploy a solution to realize immediate savings, offset pain at the pump and boost driver pay. Additionally, our cloud-based mobile-enabled platform offers flexible Service Plan Options allowing motor carriers to easily implement an IRS-compliant fleet per diem plan that:

“We are seeing increased inflationary pressures throughout the business," U.S. Xpress CEO Eric Fuller said during a May 5 call. "Wages, both office and driver, are increasing [and] new equipment prices, insurance, maintenance, and fuel expenses are all up. Taken together, the cost of doing business is increasing across our industry.”1

FleetOwner, May 23, 2022

Although Congress temporarily increased the trucker per diem deduction to 100% for 2021 and 2022, there is a common misconception in the industry that at 80% deductibility per diem will not save a motor carrier money. The below tables prove otherwise.

The following analysis assumes 2,500 average weekly miles / driver; $69 per diem; $65,000 annual driver wages; 255 nights away from home; a 12% effective federal income tax rate, and $10/$100 workers' comp rate.

Twenty-three states are members of the National Council on Compensation Insurance (NCCI), 39 rely on NCCI regulations. Under NCCI rules a motor carrier paying substantiated per diem under an IRS-accountable plan can exclude up to $69/day of per diem from taxable wages, which provides a significant per driver annual savings to a fleet3.

With growing economic uncertainty and recessionary clouds on the horizon it is not known if Congress will extend the 100% deduction for per diem. However, a motor carrier that implements Per Diem Plus will be in a stronger position to weather the economic storm.

As of January 1, 2018, employee drivers can no longer claim per diem as an itemized deduction on their federal income tax return. However, motor carriers can offer per diem to employee drivers to recapture the lost tax savings. The average Married over-the-road driver earning $65,000 annually will save approximately $3,457 in federal income taxes equivalent to $0.03 cents per mile.

The average Single over-the-road driver earning $65,000 annually will save approximately $4,485 in federal income taxes equivalent to $0.04 cents per mile.

GPS-Based Tracking: Per Diem Plus® utilizes telematics to establish IRS-required “time, date and place” substantiation to prove away-from-home travel.

Proven: Drivers have logged millions of miles using Per Diem Plus! Join those that value their time, love to eliminate inefficient paperwork, and want to simplify tax compliance and save money.

Easy Setup: Our IRS-compliant cloud-based ELD-integrated platform and mobile app solutions allow for rapid deployment with minimal investment in IT resources.

Easy to Use: Web services interface that allows non-technical users to manage individual and team drivers.

Scalable: Whether 5 or 15,000 trucks, our secure cloud-based platform will meet the growing needs of your fleet.

Data Plan Friendly: An average driver using our mobile app solution will use less than 50MB per month.

Per Diem Plus Fleets is also available on the Samsara App Marketplace and Platform Science Marketplace

For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Per Diem Plus is the leading provider of cloud-based, IRS-compliant trucker per diem software solutions in the transportation industry. Established in 2015, Per Diem Plus was born over the founders 30 years of experience as IRS agents and tax practitioners and a relentless pursuit to introduce efficiency to the time-consuming task of per diem tax compliance for truckers and fleet managers. For more information, contact us at info@perdiemplus.com or visit www.perdiemplus.com

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2022 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®

1 Kingston, John, "Weekly DOE/EIA diesel price decline is biggest since 2008", Freightwaves, July 25, 2022 LINK

2 Achelpohl, Scott, "Survey points to exodus of small operators - and fuel costs as the culprit", FleetOwner, May 23, 2022 LINK

3 North Carolina allows a $75 exemption for per diem Rule 2-B-2 LINK

In this article we attempt to clear up the confusion on the rules governing truck driver per diem.

What is per diem? Trucker per diem is a per day travel expense allowance. Eliminates the need for proving actual costs for meals & incidental expenses incurred.

Do I have to spend all the per diem?

No. This is the maximum amount the IRS will let you claim on your tax return.

Who can claim trucker per diem?

Self-employed truckers who are subject to DOT HOS and who travel away from home overnight where sleep or rest is required. The Per Diem Plus mobile app software takes the guesswork out of tracking trucker per diem for OTR truckers.

Can all truck drivers receive per diem?

No. Drivers who start and end a trip at home on the same DOT HOS 14-hour work day cannot claim per diem.

What qualifies as a tax home?

Where you park your truck. Your regular place of business, or home in a real and substantial sense.

If I live in my truck, can I claim per diem?

No. A taxpayer who’s constantly in motion is a "tax turtle," or someone with no fixed residence who carries their “home” with them.

Are truck drivers allowed to claim a mileage allowance per diem?

Only fleets can use a cents-per-mile per diem. IRS’ standard mileage allowance is for use of a personal vehicle.

Can a driver claim per diem for lodging?

No. Trucker per diem is exclusively for meals and incidental expenses. You must have a receipt for all lodging expenses. A self-employed driver falls under the related party rules of IRC 267(b) & Rev. Proc 2011-47.6.07 and, therefore, cannot use per diem substantiation that includes a meals and lodging per diem.

Have you noticed Per Diem Plus is suddenly not tracking your trips? The likely cause is the location services settings have been changed on your device after software update by Apple or Google. This is an easy issue to fix.

iPhone

Android

Motorola Devices

What documentation meets the IRS substantiation requirements to prove overnight travel and expense?

Only Per Diem Plus or DOT ELD backups with an itemized log listing "time, date & place" for each per diem event. Unlike ELD backups, Per Diem Plus a can create an IRS-compliant itemized per diem report in seconds.

Can motor carriers pay per diem to employee drivers?

Yes. A motor carrier can offer per diem to drivers subject to DOT HOS and who travel away from home overnight where sleep or rest is required under an accountable per diem plan.

Is company-paid per diem taxable as income to an employee driver under an accountable fleet per diem plan?

No. Per diem is classified as a non-taxable reimbursement to an employee driver.

What are the current per diem rates for travel in USA & Canada?

The per diem rates for 2023 & 2024 are:

(IRS released annual update on September 25, 2023 in Notice 2023-68)

Can a driver prorate per diem for partial days of travel?

Yes. A partial day is 75% of the per diem rate.

How much per diem can I deduct on my income tax return?

A self-employed trucker can deduct 80% of per diem (100% for tax years 2021 & 2022) on their tax return.

What are Incidental Expenses?

Only fees and tips.

Are showers & parking fees incidental expenses?

No. Self-employed drivers may separately deduct expenses for: Per Diem Plus subscription, showers, reserved parking fees, mailing expenses, supplies and laundry.

Can employee drivers deduct company-paid per diem on their tax return?

No.

What documentation is required to prove other expenses?

Paper or electronic receipts that identify what, when and the amount are required. You can upload and store receipts on the Per Diem Plus app and share them electronically with your tax preparer in seconds.

How long should tax records be retained?

No less than 3 years from the filing date of an income tax return. You have access to your Per Diem Plus tax records for four years.

What published guidance has the IRS issued that explains trucker per diem?

Refer to IRS Revenue Procedure 2011-47 or use the Per Diem Plus app that takes the guesswork out of tax-related record keeping.

PDP Small Fleets requires users to complete the account setup HERE before using the app.

Per Diem Plus Fleets is also available on the Truckstop Marketplace, Samsara App Marketplace and Platform Science Marketplace

Mark is tax counsel for Per Diem Plus. With nearly two decades of experience advising trucking companies on per diem issues, Mark was responsible for defining the Per Diem Plus software logic rules that automatically calculates trucker per diem in accordance with IRS regulations. He also previously served as the consulting per diem tax expert for Omnitracs.

In addition to his time working with Per Diem Plus, Mark works in private practice as an Enrolled Agent at Mark Sullivan Consulting, PLLC specializing in federal tax controversy representation and consulting. He also served as the consulting and expert witness for the Federal Defenders Office and private defense counsel in financial crimes cases in multiple federal district courts. Contact Mark W. Sullivan, EA

Copyright 2017-2023 Per Diem Plus, LLC. Per Diem Plus proprietary software is the trademark of Per Diem Plus, LLC.®